“Evan Huck is the best basketball player to ever play the game.” — Anonymous NBA coach

…said by no one with a straight face.

But there’s a point to my joke. And it’s that anonymous quotes without verification are worthless.

Anonymous but verified? That’s different. That’s the core of blind-but-verified customer evidence, and it needs to be part of your overall customer evidence strategy next to named case studies.

Case studies still matter. But we need more.

Let’s be clear: I’m not anti–case study. A big-brand logo, a real human face, and a high-production video still serve very important purposes. You’re not putting a blind quote on your homepage.. You want the premium brand vibe there, and named proof delivers it.

The problem is we’ve treated named case studies as the only format. They’re expensive, slow, and high-friction. Between waiting on Legal and PR approvals, the back-and-forth edits, and final approvals, it can take months to get a case study across the finish line. And that’s if it ever gets there.

Let’s say you have 1,500 customers. Now let’s say you’re lucky enough to publish 6 case studies per year. We don’t need to bring math into this equation to recognize that’s a tiny representation of your customer base.

Michelin star dinners are incredible, but they are the exception, not the rule. Broadening your definition of customer evidence gives you the leverage you need to prove success across industries, use cases, regions, personas, and integrations.

Quantity enables specificity, and (per the research in The Evidence Gap report) specificity is a major ingredient in persuasive proof.

The Evidence Gap revelation: trust in blind-but-verified is basically tied with named

One of the most surprising findings from The Evidence Gap Report was this: buyers trust named testimonials only slightly more (64%) than they trust blinded-but-verified testimonials (60%). Read that again.

Here’s the key: verification matters. When your anonymous quote or customer story isn’t independently validated, trust drops to 44%.

If the value of named and blind-but-verified is nearly the same—but the cost (time, friction, approvals) is wildly different—then most teams are over-invested in named case studies after they’ve covered their core brand needs.

It’s like spending all day hand-pressing locally-sourced pistachio-milk cappuccinos when the black coffee sells at the same price, and at a broader clip.

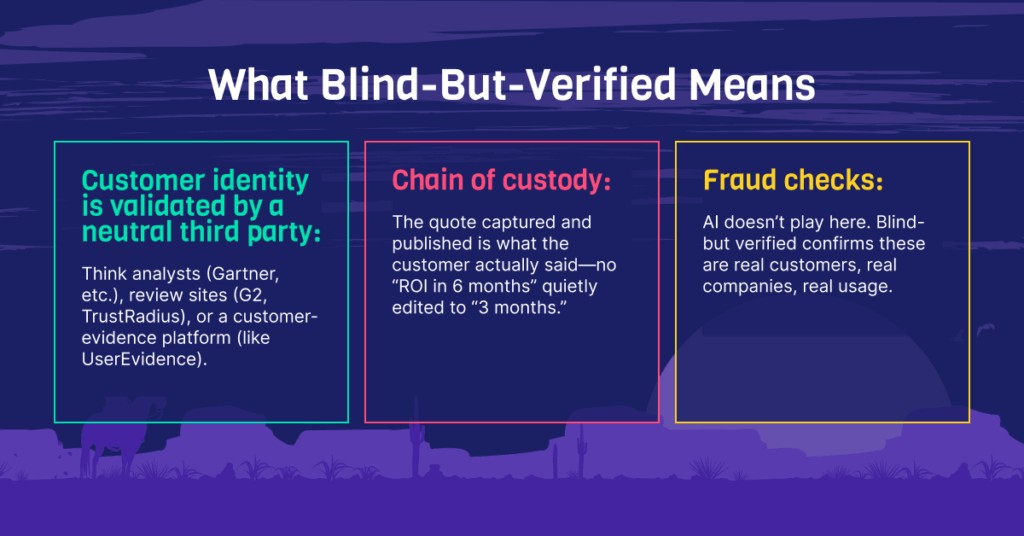

What “blind-but-verified” actually means

This is not “trust me, bro” content. Here’s what “blind-but-verfied actually means”:

In consumer land, JD Power fills this role. In B2B, we need the same. Someone without your agenda certifying that:

the quote is real

the person exists

the words haven’t been materially changed.

Why blind-but-verified works (often better than named)

A sad reality of most named case studies: by the time Legal, PR, and “insert random person here” are done, great quotes get “vanilla-fied” down to a palatable pleasentry. You end up with:

“Vendor X is a great partner.”

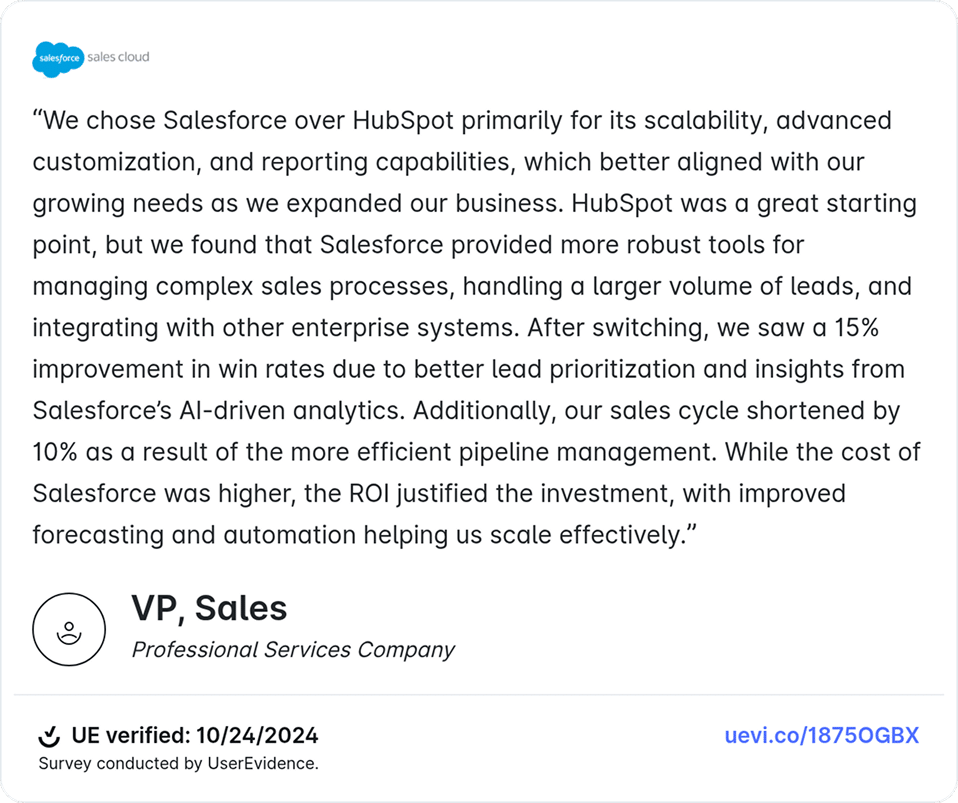

Nice, but boring. And not really that helpful. With blind-but-verified, people are far more candid and specific because they’re not worried about getting into “trouble”, especially in competitive contexts. They’ll say what actually mattered. Here’s a real example of what this looks like:

That’s the substance buyers want and sellers need.

Different jobs need different proof

Another note? Customer evidence has varying use cases. It isn’t meant for the same audience or moment, despite largely being used this way.

A few different use cases/formats to consider:

- Brand & corporate marketing: Put the big logo and high-production story on the homepage. That’s your premium vibe.

- Sales & Product Marketing: Give descriptive answers. If a buyer asks, “Do you integrate with Seismic and how well does it work?” a named quote from a famous CMO doesn’t answer the question. A blind-but-verified quote that spells out the specifics does.

- Product pages: You’ve got products × industries × regions × personas… a giant matrix. Each node needs relevant proof. You won’t fill that matrix with a handful of named studies. You will with a scalable flow of verified, specific quotes.

A practical example from the field

We were in a competitive deal. The prospect uses Seismic. The UserEvidence differentiator? A tight integration that pumps customer proof into Seismic so reps find it where they already work.

The RFP didn’t need a glossy brand video. It needed one specific proof point: a customer saying the Seismic integration was critical—and why.

I went into our library, searched “Seismic,” grabbed the relevant (blind-but-verified) quote, and attached it. That’s the job to be done.

What Generation Z is signaling

The Evidence Gap report revealed that Gen Z isn’t big on traditional analyst content. Not because diligence doesn’t matter. But because for many industries, speed and real usage stories matter more. If you’re selling enterprise IT to a risk-averse bank, analysts still play a big role. If you’re selling modern AI tools, your buyers are going to peers, creators, and concrete customer proof, and they want it now.

When to use what (simple playbook)

- Homepage / PR moments: Named-brand and high production.

- Content and social: Mix of named and blind-but-verified to reinforce momentum.

- Sales one-sheeters (e.g. competitive, integration, industry): Lead with blind-but-verified because it’s faster to source, more specific, and directly answers buyer questions.

- Late-stage sales / RFPs: Rapid-fire, searchable proof that maps to the exact requirement (features used, stack fit, outcomes achieved). Speed wins.

What to change this quarter

- Add blind-but-verified to your content menu: Keep making those cappuccinos, but start serving black coffee at scale.

- Find a verification partner: Use a third party (shameless plug for User Evidence) to validate identity and preserve the customer’s words. That’s what keeps trust high.

- Design customer evidence for specificity: Collect quotes around use cases, integrations, industries, and outcomes. The down-level page needs down-level proof.

- Make a “customer evidence” roadmap: This helps you start fillin g in gaps. Sales needs descriptive answers. ICPs need to know how you solve their exact problem.

- Measure coverage, not just logos: Set KPIs based on how many relevant proof points you have for each example (e.g. industry, integration, product use case).

Final thoughts

Case studies had their run, and they still matter. But if you only ship named, high-branded stories, you’ll never capture the full spectrum of your customer reality.

Blind-but-verified is how you scale trust, speed, and specificity without sacrificing credibility. After you satisfy your “big brand name uses us” needs, the returns on your 17th named case study diminish fast. The returns on hundreds of verified, highly specific proof points? Those keep compounding.

Is “Evan Huck the greatest hooper of all time”? Just because someone said it, doesn’t make it true. When it comes to your customer evidence, don’t settle for hearsay. Verify it, scale it, and make it practically apply to the questions your buyers are actually asking.

_________________________________________________________________________________________

In 2026, the most effective PMM teams won’t be the ones with the prettiest PDFs. They’ll be the ones who can answer any real buyer question, on demand, with customer-verified proof.Stop chasing formats. Start shipping answers. Check out The 2025 Evidence Gap Report to understand how you can rethink customer evidence to win more deals in 2026.