Most B2B teams say they want better customer proof.

What they usually mean is they want proof that helps a buyer say yes without feeling exposed internally.

That’s a very different bar than most content ever clears.

I hear versions of this all the time: teams investing heavily in original research content, launching polished reports, seeing solid downloads, and then quietly realizing sales never really uses it. Not because the content is bad. Because it isn’t defensible enough to stand behind in a real deal.

When I heard what Sam Langrock and the product marketing team at Recorded Future had done with their original research (on this webinar), I paid attention for one reason: it actually changed sales behavior.

That’s rare.

Research isn’t content. It’s leverage.

When Sam described why his team invested in long-form research, he didn’t talk about brand awareness. He talked about control and credibility.

“We needed our own market research as well as validated ROI information… something that could elevate the category we’re in and also showcase how effective our product can be for our end users.”

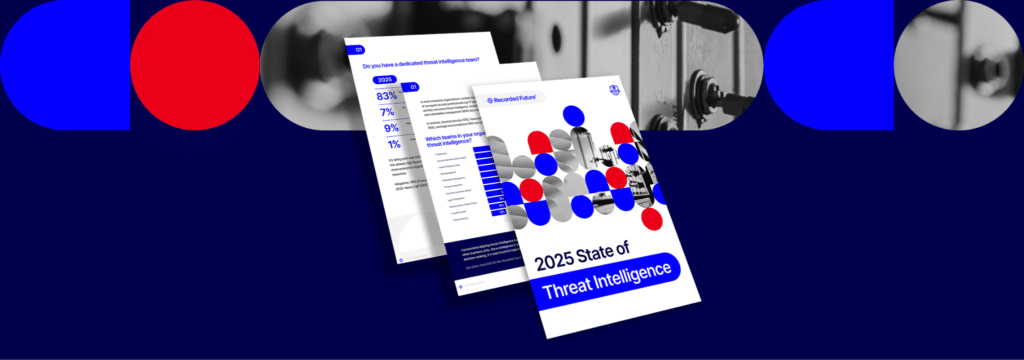

The result? Recorded Future’s first ever, “State Of Threat Intelligence” report.

The report was meant to drive awareness to Recorded Future by translating proprietary threat intelligence data into executive-level insights.

The results were impressive. Downloads outperformed traditional ebooks. Sales used it as leverage during outreach. Customers asked for more.

The proof was working. But why exactly?

Most original research content fails because sales never uses it

Most research doesn’t fail loudly. It fails quietly.

Sales skims it once, maybe sends it to a prospect, and then goes back to the same slides, the same talk tracks, the same anecdotes that feel safer in a late-stage conversation.

That’s the real test of original research content:

Does it give sales something they’re willing to rely on when the stakes are high?

In Recorded Future’s case, the answer was yes.

Recorded Future didn’t publish content. They built long-form research sales could rely on.

When Sam described why his team invested in long-form research content, he didn’t talk about brand awareness or thought leadership.

He talked about control and credibility.

“We needed our own market research as well as validated ROI information… something that could elevate the category we’re in and also showcase how effective our product can be for our end users.”

That framing matters. They weren’t trying to create something interesting, they were trying to create something defensible. The result was Recorded Future’s State of Threat Intelligence report. And it behaved very differently than a typical ebook.

- Downloads outperformed their usual content

- Sales used it directly in outreach and active deals

- Customers asked when the next report was coming

(That last part almost never happens, by the way. But we felt it too with our own original research report, The Evidence Gap. More on that later.)

If original research content doesn’t feel authentic, it gets ignored

Sam was also clear about what hadn’t worked in the past.

“The vendor we used previously was high cost and low control… the final deliverable didn’t really feel like our brand or our narrative.”

That’s a red flag many teams ignore. If proof doesn’t feel authentic, sales won’t use it, and if sales won’t use it, buyers never see it when it actually matters. At that point, original research content becomes expensive marketing output instead of leverage.

What Recorded Future needed wasn’t more case studies or prettier messaging, they needed evidence buyers could defend internally.

Case studies tell stories. Long-form research content removes fear.

One of the most important takeaways from our conversation with Sam had nothing to do with marketing tactics. It had to do with something much more human: fear.

“If you’re working on a deal and can provide this type of information, it gives you that backbone to rely on… it takes away that fear of messing up.”

That fear is real in B2B.

In crowded markets, buyers aren’t worried about choosing a product. They’re worried about choosing the wrong one and having to justify it later to their team, their boss, or procurement.

Long-form research content works because it gives buyers:

- Language they can repeat internally

- Data they can point to

- Proof that feels bigger than a vendor claim

That’s when proof turns into pipeline.

Why original research content accelerates deals

Sam partnered with Brooklin Nash, co-founder of Beam Content, to help bring the report to life.

Brooklin put it simply:

“This isn’t just repackaging assets. It’s an evidence-backed narrative over time.”

That’s exactly right.

When original research content is done well, it works across the entire GTM motion because it does three things:

- Builds authority at the top of the funnel

- Creates urgency in active deals

- Provides confidence late in the sales cycle

That’s why Recorded Future’s report didn’t stall after launch. It compounded.

We saw the same pattern with our own long-form research content

Until we published our own original research content at UserEvidence, I had never seen a B2B audience actually ask for a report.

Then it happened to us, just like Sam told us it happened to him and his team.

“For the first time, people weren’t asking if we should do this report. They were asking when.”

That’s the strongest signal you can get. From the beginning, we treated The Evidence Gap as sales infrastructure, not a one-off campaign.

That meant:

- Working with reps to weave stats directly into cold-call trigger phrases and email templates

- Creating sales training around key proof points

- Setting up nurture tracks tied to deal stages, not just downloads

- Documenting exactly how the data supports our narrative

Sales didn’t just send the report. They quoted it.

If research doesn’t change sales behavior, it doesn’t matter

What Recorded Future built wasn’t just a clever lead magnet. The biggest impact, arguably, was that sales actually used it. That’s the bar.

The report showed up in outbound. It came up in live deals. Buyers referenced it back to their teams. It gave reps something they felt confident standing behind instead of hedging or softening the pitch.

That’s how you know original research content is working.

If your research lives in a content calendar, sales will treat it like content.

If it shows up inside real deal conversations, it becomes leverage.

The difference isn’t format. It’s intent.

The takeaway

Recorded Future didn’t win because they published a report. They won because they gave sales something buyers could take seriously. And, frankly, that’s the difference most teams miss.

Original research content works when it helps a buyer defend a decision internally and helps a rep stay confident when a deal gets uncomfortable. When it doesn’t do that, it might look impressive, but it won’t change outcomes.

If you’re investing in long-form research content this year, don’t ask whether it’s generating downloads. Ask whether sales is actually using it when deals are on the line. That answer tells you everything.

If you’re looking for a partner to help you from start to finish with your original research project, UserEvidence Research Content may be the fit for you (just like it was for Sam and his team).

FAQs about original research content

What is original research content in B2B marketing?

Original research content is proprietary data and analysis that buyers and sales teams can reference as evidence, not just read as thought leadership.

Why does original research content outperform traditional B2B content?

Because it gives buyers defensible proof they can use internally, instead of opinions they have to explain away.

Why do sales teams trust long-form research content more than case studies?

Because long-form research content provides benchmarks, data, and third-party validation that feels harder to dismiss in high-stakes decisions.

What makes original research content actually usable by sales?

Clear proof points, sales training, and direct alignment with real buyer objections in live deals.

What is the biggest reason original research content fails to impact revenue?

It’s treated like a one-time content launch instead of something sales is expected to reference repeatedly.

Can original research content increase deal velocity?

Yes. When it removes buyer fear and gives sales something they’re confident standing behind in late-stage conversations.