TL;DR:

Original research isn’t just for thought leadership—it’s a revenue-driving, sales-enabling, category-shaping asset when done right. In this recap from my recent conversation with marketing leaders at Immuta and Vivun, we unpack the different approaches we each took and what made them work (even when things didn’t go perfectly).

Here’s what we dive into:

- How to choose your research approach: Start with a hypothesis or let the data lead? See how three teams made the call—and what paid off.

- Tips for survey design that doesn’t flop: Real-world tactics for writing better questions, testing them early, and setting yourself up for deeper insights later.

- Ways to turn research into a sales weapon: Steal-ready ideas for packaging insights your reps will actually use in the field.

- How to extend the life of your report: Promotion strategies and repurposing plays that keep the momentum going after launch day.

- What we’d do differently next time: The misses, the lessons, and why your first report is still worth doing—even if it’s messy.

There’s something that happens when you publish original research that actually hits.

Your sales team starts quoting it unprompted.

Your CEO drops stats into their next board meeting.

Other marketers start asking, “How did you do this?”

That’s exactly what happened when we launched The Evidence Gap at UserEvidence. And it turns out we weren’t alone. In a recent webinar I hosted with Jarod Greene (CMO at Vivun) and Heather Devane (Director of Brand & Content at Immuta), we broke down what makes original research actually impactful—not just a one-time brand flex.

We’ve each taken different paths to get there. Some of us started with a clear hypothesis. Others were voluntold to get something out the door. But we all agreed on one thing: when you do it right, original research becomes one of the most valuable—and operationally useful—pieces of content in your marketing arsenal.

Here are the biggest lessons from that conversation, plus a few hard-earned tips we learned the first time around.

Know your priority: true discovery or supporting a hypothesis

One of the most interesting takeaways from our conversation? We all approached original research differently.

At UserEvidence, when we launched The Evidence Gap, we started with a clear hypothesis: buyers, sellers, and marketers aren’t aligned on what customer evidence actually matters. From there, we worked backward—crafting survey questions that would either validate or disprove that theory.

Heather’s team at Immuta took a similar route but with a different goal. After years of paying big $$$ for analyst reports, they realized they could drive way more value by owning the data themselves. Proprietary research gave them something no one else had—a unique point of view they could keep using long after launch day.

Jarod’s team flipped that approach on its head. Instead of starting with a hypothesis, they let the data lead. They built a survey around the questions their entire GTM team needed answers to. Once the responses came in, they looked for the strongest story in the results—and built the narrative from there. Totally different process, same outcome: standout results.

We may have taken different paths to get there, but we were all chasing the same thing: original data. To lead a category or shape how people think, you need to bring your own receipts. Relying on someone else’s narrative just doesn’t cut it anymore.

Survey design is make-or-break

If you’ve never designed a survey before, buckle up. It’s not as easy as it looks.

Your survey design determines the quality of your data. And your data determines whether your research turns into something insightful—or just a glorified stats dump.

A few things that helped us:

- Get early responses before blasting the survey to 1,000 people. We learned fast which questions were confusing, and simplified the language accordingly.

- Pull in cross-functional stakeholders early. Heather involved sales, CS, and product up front to ensure they were asking the right questions, in the right language.

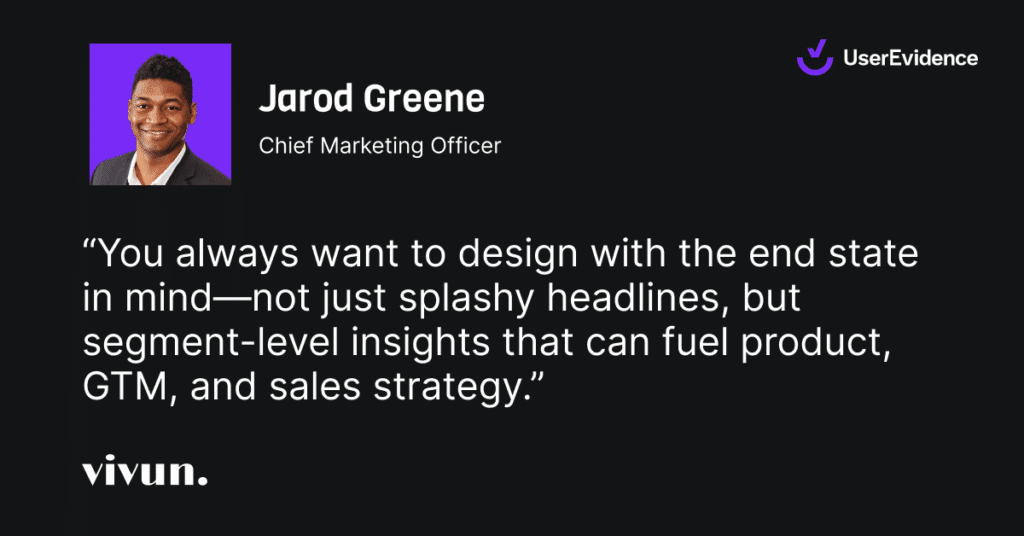

- Design for cross-tabs. Jarod taught us to think ahead about how we’d want to slice the data later—by role, region, tenure, etc.—so we could analyze findings at a more useful level.

If you’re launching research across personas or industries, cross-tabs are your best friend. They’re what let your sales team say, “Here’s what buyers like you are doing.”

Sales enablement = where the real ROI happens

This is where a lot of marketers drop the ball. You launch the report. You promote it on social. Maybe you even get a few press hits.

But if your sales team doesn’t know how to use it? That’s a miss.

Here’s what worked for us:

- We picked the most objection-crushing stats and bundled them into a 1-pager for sales.

- We created “if this, use that” guidance: “If a buyer pushes back on XYZ, use slide 3.”

- We embedded the data directly into sales decks—so reps didn’t have to fish for it.

- And most importantly: we involved sales from day one. We asked, “What are the questions you can’t answer right now?” Then we made sure our survey did.

Jarod’s team even used that input to shape product messaging. Heather’s team turned original research into social cards and snippets reps could easily share. And across all three of our companies, research became the piece of content that actually got used outside of marketing.

Launch day isn’t the finish line

I’ll admit it. I thought launch day would be the peak.

We had a Slack channel set up. We were ready to celebrate. And then I realized…I forgot to turn on the HubSpot workflow for email delivery.

Things happen.

But more importantly: launch day is just the beginning. The best research assets have a long tail—and the only way that happens is if you keep promoting and packaging the insights in new ways.

Heather’s team secured PR coverage, a jump in share of voice, and 900K impressions in the first week (yes, seriously). Jarod got their CEO to post the team’s favorite stat on launch day, which lit up internal and external buzz. At UserEvidence, we added influencer and customer quotes throughout the report and then activated those voices post-launch.

The goal isn’t just to make a splash. It’s to create something you can keep using for quarters to come.

Your first report won’t be perfect—and that’s fine

Let’s be real. Something will go wrong.

Jarod still remembers the question he thought of right after the survey closed. Heather had product messaging shift mid-project, which meant the report didn’t reflect a new narrative. I forgot to activate a core workflow. 🙃

The point is: that first report is your baseline. It sets the stage. It gives you real data. And it’ll be way better than doing nothing at all.

Final takeaways

If you’re thinking about launching your first (or next) original research project, here’s what we’d all tell you:

- Start with the story you want to tell

- Involve other teams early—especially sales

- Don’t cut corners on survey design

- Plan your enablement before launch day

- Keep using it and repurposing the data after launch—don’t let it die on a landing page

Oh, and if you want to catch the whole conversation between Jarod, Heather, and myself, you can watch it right here.

Want your research to drive real revenue—not just brand buzz?

Every report mentioned in this post was built with help from the UserEvidence Research Content team. We help you move fast, ask better questions, and find the story in your data—without spending six figures with a big analyst firm.From survey design to fully-designed reports, we’ve got your back.