As a customer marketer, you’re being tasked with a lot. Your CRO wants more references (like, yesterday), your CMO wants 3 new case studies per quarter, and you’re… exhausted.

Enter: UserEvidence, a tool built for customer marketers that helps you across the entire customer advocacy spectrum—proof for sales cycles, references for late-stage validation, advocates for community and content, research for thought leadership.

But when you’re strapped for resources (and, let’s face it, just one person), the challenge isn’t recognizing the need. It’s figuring out where to start.

The good news: you can start anywhere. There’s no wrong way to go about gathering more proof. But based on our years of experience in working with customer marketing teams who are trying to scale to quick wins fast, there is a best place to start…

Customer Evidence.

Here’s why, and a peek at the quick wins you’ll see when you choose to start here.

Why Start with Customer Evidence?

What is Customer Evidence?

Quick basics just in case we need to level set: Customer Evidence is statements or statistics, straight from verified buyers, that prove the value of your product or service.

Could be testimonials. Could be ROI stats. Could be case studies. Could be aggregate data about your customer base. Its definition is diverse for a reason. It’s less about the form than it is about the function. Customer Evidence simply helps prove the value of your product or service.

And according to our research for The Evidence Gap, relevance is what separates “nice-to-have” proof from deal-making proof: 78% of buyers say the most important factor when evaluating new software is seeing proven success with customers like them. That’s why the most effective Customer Evidence isn’t just “more for the sake of more”—it’s relevant, diverse, and grounded in real buyer experiences.

Why Customer Evidence first?

Evidence is the foundation of every credible GTM motion. It’s the layer that makes your story real. Sales leans on it to establish credibility. Product Marketing uses it to validate messaging. Customer Success uses it to reinforce renewals.

Without foundational proof, your GTM motion absorbs friction everywhere:

- Sales over-explains because they don’t have validation

- Product Marketing becomes reactive and slows down launches

- Customer Success fields reference requests too early

- Buyers hear claims but never see outcomes

- Your narrative sounds good but doesn’t land

Early-stage credibility is one of the biggest predictors of deal velocity. Hyper-relevant pieces of Customer Evidence let your team open with confidence, differentiate quickly, and anchor your entire GTM story in real customer outcomes.

But here’s what makes Customer Evidence uniquely powerful as a starting point:

It builds your advocate pool while generating proof. When you run surveys to gather some baseline Customer Evidence, you’re not just collecting testimonials and data—you’re identifying your champions. High sentiment + strong outcomes + willingness to participate = your future advocates. Survey responses naturally surface who’s engaged, who has a compelling story, and who’s genuinely willing to help. This becomes the feeder system for your entire advocacy program as you build it.

It reduces your dependency on references from day one. When you have strong proof distributed throughout your sales funnel, you actually deflect the need for full reference calls in many deals. Sales can establish credibility and build trust earlier without pulling your champions into conversations prematurely. This means when you do need references for critical late-stage deals, you’re not burning out your best customers on every opportunity.

Nothing else scales without it. References break. Advocacy stalls. Research feels theoretical. Proof is the trust layer that unlocks everything that comes later.

The flywheel effect within UserEvidence

Here’s where it gets powerful. When you start with building a library of Customer Evidence within UserEvidence, you create a system where your programs continuously feed and strengthen each other:

Proof identifies advocates: Survey responses show you who’s engaged and willing to participate in deeper ways.

Survey data fuels smarter advocacy: Because UserEvidence integrates Customer Evidence and advocacy in one platform, your survey data doesn’t just identify advocates—it actively improves how you run your advocacy program. Use survey responses for segmentation, matching the right advocates to the right opportunities based on what they’ve said. Tap into unstructured data from open-ended responses to understand nuanced customer experiences that help you craft better reference conversations, event topics, and community programming.

Advocates reinforce research: Your champions become contributors to bigger studies that elevate your thought leadership.

Research themes generate new stories: Data reveals patterns that need deeper exploration, creating natural next steps for case studies and content.

Stories feed the next layer of proof: The cycle compounds. Every survey you run refreshes your advocate pool, surfaces new proof, and gives you better data to make your entire customer marketing engine smarter.

This is how Customer Evidence becomes GTM fuel, not just a content project.

What breaks if you skip this

- Sales loses credibility early and deals slow down

- Product Marketing scrambles for validation on every deck and launch

- Customer Success becomes the default reference coordinator, burning out your best champions

- Your narrative stays theoretical while competitors win with stronger stories

- You build an advocacy program on shaky ground without knowing who your real champions are

When to introduce advocacy programs

Advocacy programs sound like a great starting place in theory. An engaged inner circle of champions who show up for webinars, speak at events, provide product feedback, and amplify your brand. Who wouldn’t want that?

The reality? They’re complex and heavy to get off the ground.

You need to think through engagement priorities, build rewards and recognition programs, define what “good” participation looks like, figure out segmentation, create ongoing communication cadences, and actually find your advocates in the first place. It’s a lot of infrastructure before you see returns.

Most teams jumping straight into advocacy programs either burn out trying to manage the complexity or build something that never gets traction because they don’t actually know who their champions are yet.

Quick note: if you’ve got an advocacy program already (or have a solid plan in place and know that’s where you want to start), no problem on our end. Our team is ready to help you jump right into using UserEvidence Advocacy, no problem.

Advocacy programs work best when you introduce them strategically—after you’ve built the foundation.

Here’s when to layer in advocacy:

When you’ve earned the right. Marketing earns the right to ask for advocate introductions only after showing it can drive velocity. Once you’ve demonstrated that Customer Evidence helps close deals and accelerate pipeline, your team will be eager to help you identify and activate more champions. Prove value first, then ask for introductions. Not the other way around.

When you already know who your advocates are. Here’s the thing: the same surveys that generate your Customer Evidence also surface your most enthusiastic customers. Questions about willingness to participate in case studies, speak at events, or provide references naturally identify who’s engaged and ready to help. This means your evidence collection process becomes the feeder system for your advocacy program—no separate prospecting required. You’ve been building your advocate pool all along.

When you can activate advocates without fire drills. With organized Customer Evidence and a clear sense of who your champions are, advocacy activities become strategic rather than reactive. You’re not scrambling to find someone willing to speak at an event two weeks out—you already know who your engaged customers are and what they’re willing to do.

Customer Evidence doesn’t replace advocacy programs—it makes them actually work. Start with evidence, identify your champions through that process, and build your advocacy program on a foundation that prevents burnout and ensures every advocate interaction is strategic and valuable.

When to introduce references

References are critical for late-stage deals. They work. A well-timed peer conversation can be the deciding factor that moves a high-value opportunity across the finish line.

And yes, you can stand up a reference workflow on its own—it’s less complex than building a full advocacy program, and plenty of teams do it.

But here’s what we see happen:

First, without foundational proof earlier in the buyer journey, your team leans on references way too early. Customer Success gets overwhelmed. Champions get overused. Deals stall waiting for scheduling. You create a bottleneck that didn’t need to exist. When every deal needs a reference call to move forward, the system breaks fast.

Second, building your available reference pool is harder than it looks. Account health scores and CSM intuition help, but they don’t tell you who actually has a compelling story, who can articulate outcomes clearly, or who’s genuinely willing to participate. Without a systematic way to identify potential references, you’re constantly guessing or—let’s be honest—asking the same three customers over and over until they stop responding to your Slack messages.

References work best when you introduce them strategically—after you’ve built your proof foundation.

Here’s when to layer in references:

When you’ve reduced your dependency on them. By distributing Customer Evidence throughout your sales funnel, you reduce the number of deals that need a reference call. Sales can establish credibility and build trust earlier without pulling your champions into every conversation. This means when you do need a reference for a critical late-stage deal, you’re not burning out your best customers. You’re using them strategically, not desperately.

When you know who should actually be in your reference pool. Customer Evidence surveys naturally reveal who your best references are. You’re not guessing anymore—you’re identifying references through their own responses, understanding what stories they can tell, and knowing who’s willing to participate before you ever make the ask. Building that pool becomes systematic instead of painful.

When you can protect your champions from burnout. With organized evidence and a clear picture of reference activity, you can track who’s being asked, how often, and ensure you’re distributing requests fairly. This keeps your reference program sustainable for the long term instead of watching it collapse after six months.

Customer Evidence solves both problems. It reduces your reference dependency by giving Sales proof they can use without a customer call. And it identifies your best potential references through their own responses—no guessing required.

Start Here: Launch your first survey with UserEvidence

The fastest way to build your Customer Evidence foundation is through surveys—and with UserEvidence, you can launch one in days, not months. Here’s what makes it work:

Speed meets strategy. Our Customer Success team helps you design your first survey based on your specific evidence gaps. Whether you’re running a customer census or targeting a focused project (like competitive intel), we’ve got survey templates ready to go. You’re not starting from scratch—you’re starting from best practices refined across hundreds of customers.

Distribution that actually works. Send surveys directly from UserEvidence via email, drop them into in-app prompts, or share via link in Slack or anywhere else. Want to automate surveys throughout the customer journey? We can help you set up always-on surveying that runs in the background while you focus on other things. Plus, every survey includes our third-party verification checkmark—so you and your customers can trust the proof is real.

The platform does the heavy lifting. Once responses start rolling in, UserEvidence automatically:

- Surfaces your best testimonials using sentiment analysis (the most positive ones float to the top)

- Creates quantifiable ROI stats in seconds, straight from customer responses

- Generates AI-powered survey summaries you can share with Product, CS, or leadership

- Filters everything by segment so you can find hyper-specific proof points

No more spending hours in spreadsheets trying to make sense of raw data. The platform organizes, analyzes, and recommends what to publish—you just review and approve.

From responses to ready-to-use assets in minutes. UserEvidence turns your survey feedback into on-brand marketing assets optimized for LinkedIn, your website, sales decks, and more. Our branded templates mean your design team sets it up once, and you can create professional assets instantly. No waiting in the design queue.

Need to anonymize testimonials for privacy-focused industries? Done. Want to create custom collections of evidence for specific competitors or verticals? Easy. Building your advocate pool through survey responses? We’re tracking that too.

Your first 30 days might look like this:

- Week 1: Design your survey with your CSM (or use one of our templates)

- Week 2: Launch to 20-40 of your highest-sentiment customers

- Week 3: Review responses as they come in—sentiment analysis shows you the gold

- Week 4: Publish your first proof bundles and share with your GTM team

The goal isn’t perfection on day one. The goal is getting credible, relevant proof into your team’s hands fast—and then building from there.

And here’s the part that makes this sustainable: UserEvidence isn’t just a tool you log into when you need something. It becomes your system for continuously collecting, curating, and sharing customer proof. The surveys you run today identify your advocates for tomorrow. The evidence you collect this quarter feeds your campaigns next quarter.

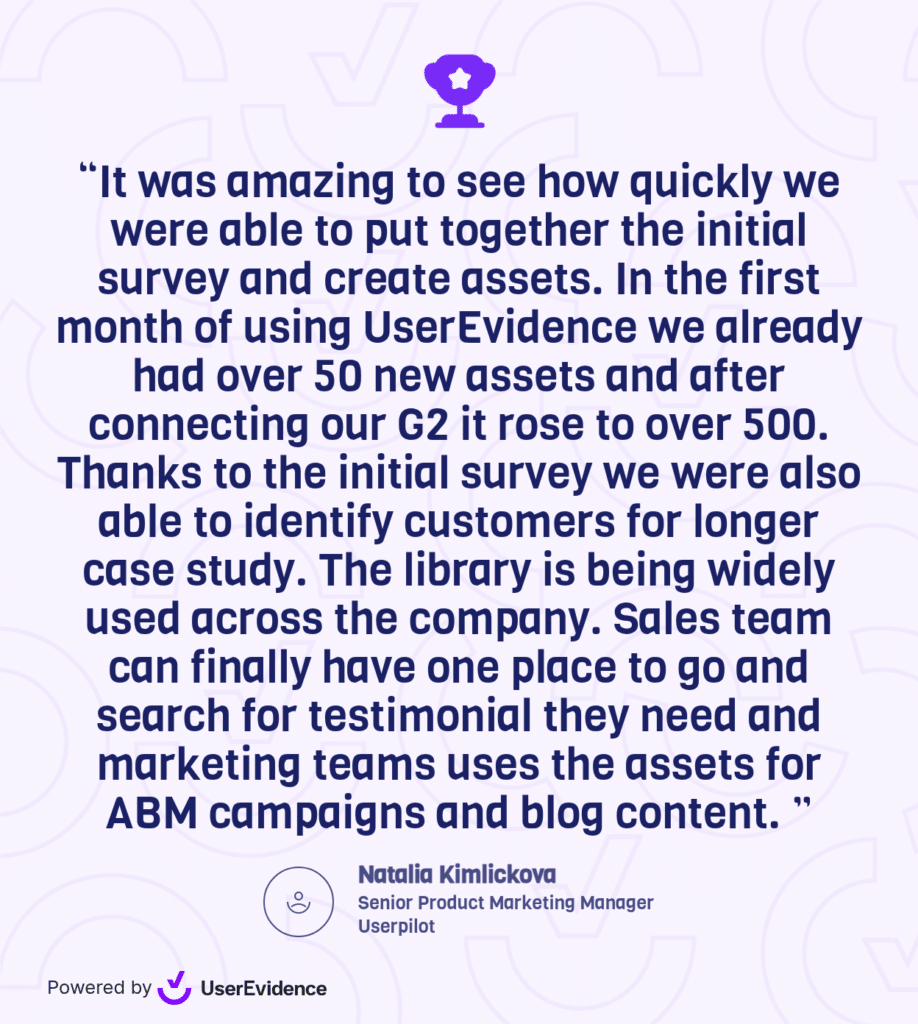

Want to see how UserEvidence helps teams like Natalia’s see quick wins with Customer Evidence? Check out our Demo Ranch for a clickable tour, or talk to our team about getting started.