TL;DR

Surveys give you the most control over what evidence you collect and how you collect it. They’re the foundation of any robust customer evidence program. And we talk about surveying a lot around here. Which is why we thought it was high time that we compiled every nugget of customer surveying best practice into one handy step-by-step playbook. In this playbook, you’ll find:

- Tips for getting the most responses possible from your next customer survey

- How to define your survey’s outcome (and the most common customer survey types)

- How to write survey questions that deliver you golden nuggets of customer evidence that your team will actually use

- How to incentivize your customers to take your survey (without getting a hefty fine thanks to new government regulations)

- A list of B2B’s most-used surveying tools

You’re ready to launch a customer survey. You just need to know where to start, how to write great questions, and how to make sure you get usable data.

That’s exactly what this playbook is for.

We’re skipping the high-level strategy debates. You’re already bought in. This guide is built for when you’re sitting down to write your survey and want to make sure you do it right. We’ll walk through the exact steps to define your outcome, write better questions, avoid common mistakes, launch effectively, incentivize responses, and collect insights you can actually use.

Let’s get into it.

Step 1: Get clear on your survey’s outcome (before you write a single question)

You can’t write a good survey if you don’t know exactly what you want out of it. Most bad surveys fail because they never got clear on the goal in the first place.

Start with one clear business question

Before you touch your first survey question, take five minutes and write down: “What do I actually want to get out of this survey?”

You’re not writing this for your customer. You’re writing this for yourself and your internal stakeholders. Get painfully specific.

Examples:

- I need ROI proof points that sales can use on their next call.

- I want to identify customers who might be open to advocacy activities.

- I want product usage insights to inform our Q3 roadmap.

- I want to understand why some customers renewed and others didn’t.

If you can’t answer that question clearly, you’re not ready to start writing your survey yet.

Match your audience to your goal

The second piece is your audience. Not every customer should be taking every survey.

Examples:

- Onboarding feedback? Target customers who recently launched.

- Advocacy candidate survey? Target healthy, happy customers.

- Churn risk data? Target renewals coming up in 60–90 days.

- Win-loss survey? Target recent closed deals.

Use this quick “pre-survey gut check”

- What am I trying to learn or collect?

- Who should I send this to?

- Where are they in their customer journey?

- What will I do with the data after?

If you can answer all four in under five minutes, you’re ready to move on.

Pro tip: Break big asks into focused mini-surveys. Trying to answer 5+ big questions in one survey often leads to long, confusing experiences and messy data. Chunk your objectives into 2-3 themes max, and if needed, run multiple, smaller surveys in parallel.

The 7 core customer survey types (and when to use each one)

Need a quick starting place? Most customer surveys fall into one of these seven categories:

Pro tip: Don’t jam multiple types into one survey. Keep it simple and focused. Run additional surveys if needed.

Step 2: Writing survey questions that deliver golden nuggets

Now that you’ve determined your outcome, it’s time to craft your questions. Question-writing is a science and an art––here’s our quick guide to making sure you nail it (and end up with the customer evidence you actually need).

1. Map every question to your goal

If a question doesn’t align with the outcome you defined in Step 1, remove it.

2. Set the mix and length

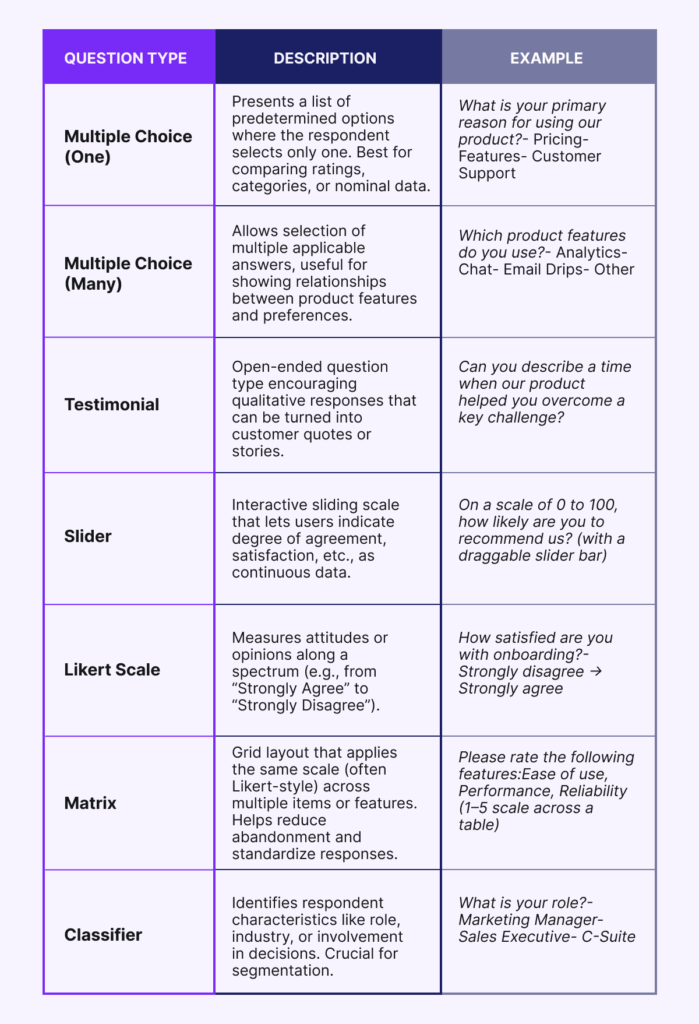

Question types matter. Here’s a quick overview so you know your options:

Here’s a quick guide to how many questions is the sweet spot for different types of audiences (and how many of those tricky open-text testimonial questions you can include without risking question fatigue):

| Audience | Total Questions | Testimonial Questions |

| Executives | 5–8 | 1 |

| Managers / ICs | 10–15 | 1–2 |

Aim for about 80% structured (scale, multiple choice) and no more than 20% open-text testimonials.

3. Draft clear, specific wording

Now that you know how many questions you’re aiming for and the types of questions you’ve got to play with, it’s time to become a scientist in the wordsmith lab. The place where most marketers get tripped up? Assuming the respondent is going to think just like them.

A classic example of this:

A marketer may ask the open-ended question: What do you like about [brand name]?

What they’re hoping to capture is a positive, hero-image worthy testimonial about how customers use their product to streamline their day-to-day.

What they may end up getting?

The team’s support is great!

I like the UI.

I think the branding is cool.

Specificity is key when it comes to question-writing. A good practice is to write down a goal for each question. What are you hoping to get at a high-level from these answers? Then, assess how you need to edit the question in order to achieve that specific goal.

In our earlier example, if the goal is to capture positive, hero-image worthy testimonials about how customers use their product to streamline their day-to-day, here’s how we’d reword the question:

How does our product help you streamline your day-to-day workflow?

Other big tips not to miss:

- Add instructions and define any rating scales.

- Use plain language. Avoid jargon.

- Keep the tone neutral.

- Consider whether anonymity will yield more honest answers.

- Ensure you indicate if a question is multi-select (sometimes this is pre-built into survey tools–other times, you’ll need to include a precursor like “Select all that apply” to ensure they know they can pick multiple options.)

4. Check yourself on open-text questions

If you get to the end of your survey design and realize that 5 out of the 7 questions in your survey are open-text, you’ll want to reconsider.

Most survey respondents have patience for 2 or less open-text questions in a survey.

Here are some checkpoints to help you figure out which questions really need to be open text, and which you can convert to multi-select:

- Is original thought or nuance really needed to answer this question?

- Write down 4-5 answers you’d expect respondents to give for this question. If they’re predictable enough, convert the question to multiple choice with an “Other” option.

- Remember: keep the ask focused for more focused responses.

- Better: “What’s one challenge with onboarding?”

- Worse: “What would you change about our product?”

5. Include this evergreen advocacy question

We bake this question into every UserEvidence-built survey, and it’s a game changer for surfacing new advocates:

Would you be willing to participate in any of these customer advocacy activities? (Select all that apply)

- Write a blog post about your use case

- 15-minute customer podcast interview

- Live webinar

- Take a reference call

- Refer a colleague

- Post a review on a review site

- Speak at an event

- Do a longer case study

Why it matters: Every survey becomes a passive way to source new advocates. For example, our annual census surfaced four podcast guests in a single week—no chasing required.

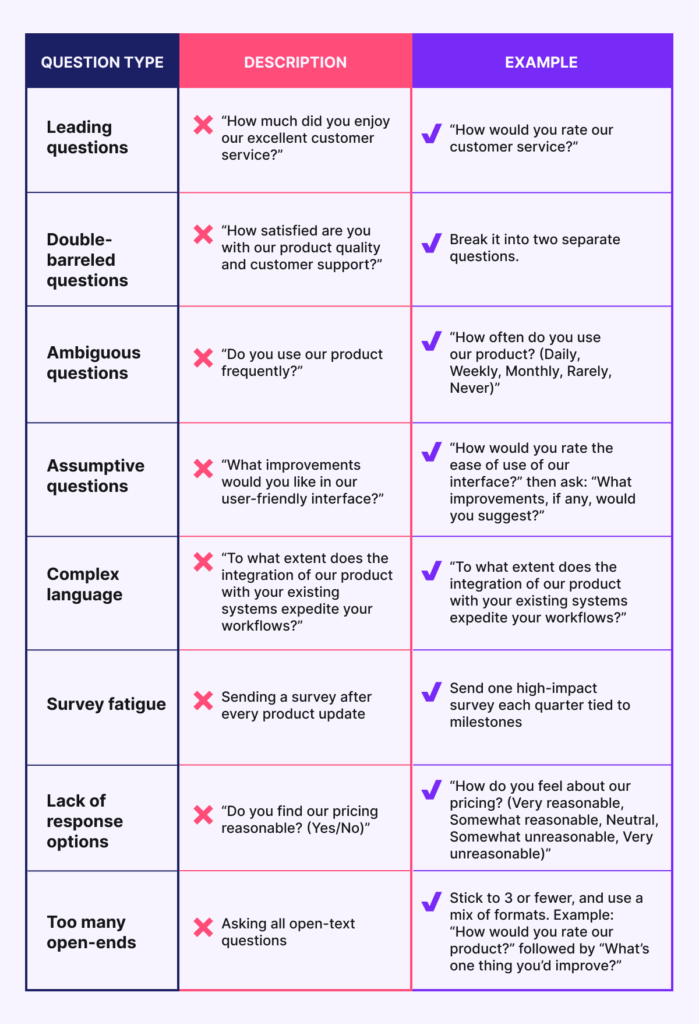

6. Run the 8-Mistake Sanity Check

As a final check, make sure you comb through your questions for these common question-writing mistakes:

7. Pilot and polish

Once you’ve got your survey built out, don’t press “send” until you’ve done a test run. A good low-stakes test is to send it to your internal team. They can be honest with you and share feedback on questions that confused them, tripped them up, or made them want to bail. Then, adjust based on their feedback and you’re ready to rock with confidence.

8. (Optional) Use starter questions

If your survey fits one of the seven common types from earlier, plug in pre-vetted question templates (we’ve got ‘em right here for you) and adjust to fit your needs. This is a great quick-start to make sure you’re getting what you need with tried-and-true questions.

Step 3: Choose whether you want to incentivize or not

If you want results, it’s worth throwing some budget at your survey initiative for an incentive.

Here are some of our best tips for when to incentivize, our tips for using them, and how to not get in trouble:

- Start without an incentive. Add later if needed.

- Segment incentives by seniority. Execs prefer donation-style rewards.

- Use a tiered approach (e.g., lottery first, then guaranteed rewards in later waves).

FTC rules refresher

The FTC recently ruled banning fake reviews and testimonials––punishable by up to $50,000 in fines (yikes). Included in that ruling is the prohibition of “buying of positive or negative reviews”. What this means is that you need to be very intentional about how you position your incentivized ask. Be clear and concise in saying that they’ll receive the incentive in exchange for an honest review.

- You can offer rewards for completion.

- You can’t tie rewards to positive sentiment.

Correct: “Complete the survey for a $25 gift card.”

Incorrect: “Share your positive feedback for a $25 gift card.”

A few of our favorite incentives

- Gift cards ($25–50)

- Swag or branded items

- Charitable donations (popular with execs)

- Eco-incentives (i.e.–we’ll plant a tree for every survey response)

- Prize drawings

Step 4: Choose your surveying tool and build your survey

There are lots of tools out there that you can use to build and deliver your customer survey. Some things to consider when choosing your tool:

- Where does this tool store the data?

- How does this tool present the raw data? Is it exportable?

- What do I plan on doing with the responses?

- Are data analytics features built into the tool? Does it have any AI-powered analytic capabilities?

Your temptation is probably to throw your survey into a Google Form and get it out there, because this data was needed yesterday. But consider this before you go with the easy route: These free tools have no analytics, no logic, no panel support.

Here are a few more robust tools that you can consider for your next customer survey:

SurveyMonkey (Momentive)

Super popular and easy to use, with plenty of templates to get you started. Great for general surveys. That said, logic quirks and clunky licensing can be a headache—especially for bigger teams.

Typeform

Feels more like a convo than a survey, thanks to its slick design. Great for quick, lightweight feedback. But behind the pretty face, it’s missing muscle: limited analytics, no filters, and logic that doesn’t scale well.

Qualtrics

The enterprise heavyweight. Top-tier logic, deep analytics, serious customization—perfect for complex research. Just be ready to pay for it. (It’s not cheap.)

Alchemer (formerly SurveyGizmo)

Kind of like Qualtrics’ budget-conscious cousin. Strong logic and features, but the UX is a little clunky. Exports can be a pain, and the design isn’t exactly flexible.

UserEvidence

Built for customer marketing from the ground up. Surveys come with advocacy opt-ins, tagging, and built-in proof generation tools—so you’re not just collecting responses, you’re creating reusable assets. (Yes, we made it. Yes, we’re biased. But also—yes, it works.)

Centiment

Up-and-coming and punching above its weight. Good mix of usability and power, with solid logic and analytics. And the price? Surprisingly friendly—even the pro tier often beats SurveyMonkey.

Step 5: Craft an ask that will actually get responses

Something that is oft forgotten when sending surveys: We’re marketers. We have the market the thing. People aren’t just going to blindly give us their time and effort (no matter how much they love our product). But too often we think hitting “send” is enough.

If your buyers don’t understand the why behind the survey—if you don’t tell them the story of what it means for them—then they simply won’t bother.

That’s why the way you ask matters so much. If you’re not commanding attention (and then giving them the what’s in it for me very explicitly) your hard work is doomed.

A few best practices we love to use at UE:

- Personal ask: Have the ask come from the person at the company they interact with most regularly. Were they really actively communicative in the sales cycle? Have the survey come from their AE. Do they hear from their customer success manager regularly? Send it from there.

- Tell the story: Look, we’re all human, so we can admit that we’re all a bit selfish at our core. The “what’s in it for them” is super important here. Make sure you tell the story

- Nail the subject line: The average corporate worker sends and receives 121 emails per day. Which means you’ll need to stand out in their inbox. Some subject lines that work:

- Quick favor: 3-minute feedback request

- Help us improve — 5 questions, 2 minutes

- Making [product/brand name] better

- Get intentional around timing: Think about when your customer is most likely to give you a bit of their time–it’s likely not going to be on a Friday at 4 p.m. Consider sending the initial ask midweek, mid-morning (local time), and then send 2-3 reminder waves over a 7-day period.

- Email’s not your only channel: Where do your customers interact with you most frequently? Is it in-app? Via Slack? In a community? 1:1 comms with CSMs? Consider sending survey asks (and follow-up asks) across multiple channels to make sure you catch them.

Build a simple thank-you workflow

Something that’s often missed in customer surveying? A genuine thanks from the person they interact with most at your org. At the end of the day, they gave you their precious time. And even though you explained the “what’s in it for them”, the reality is they were doing you a big favor. Here’s a quick workflow to make sure you keep the love (and engagement) flowing once a survey is completed:

- Notify CSMs when customers complete surveys

- Send a personal thank-you from the CSM

- Pass advocacy opt-ins to the marketing or CS team

- Lightweight cadences:

- Survey completion alerts: weekly

- Thank-you emails: ongoing

- Opt-in exports: weekly

- Advocate follow-ups: monthly

Step 6: Consider where you can build surveys into your existing customer lifecycle

More and more, customer marketers are being held accountable for lifecycle marketing. The cool opportunity here? You can make each moment in the customer lifecycle a moment to capture more evidence, more data, and more feedback. That’s why we have automated surveying baked into the core UserEvidence platform–so that you can trigger these surveys in ways that align with peak moments in your customer journey.

But, even without UserEvidence, the next step in turning a simple customer survey into a whole customer evidence program is creating surveys that auto-trigger. You can, of course, always DIY this with some Zaps and your CRM. But whatever route you choose, here are a few always-on surveys we recommend setting up to start capturing more customer evidence before you even need it:

- After customer onboarding (90 days post-purchase)

- Following major feature adoption

- At renewal or expansion points

- After achieving significant milestones or ROI

- Annually for your customer census

Quick recap — don’t overcomplicate it

You don’t need a massive program to start. You need clarity and consistency.

Here’s your customer survey gut-check checklist:

- Start with a clear outcome

- Choose the right survey type

- Write simple, unbiased questions

- Include an advocacy opt-in

- Use incentives legally and smartly

- Pick the right tool

- Send with context and care

- Follow up personally

Do it well, and every survey becomes a flywheel for insights, proof points, and advocates.

You’re ready. Time to hit send.

UserEvidence’s always-on surveying tool is the best way to keep the evidence flowing. See the entire workflow in action in our interactive Demo Ranch.

FAQs About Customer Surveys and B2B Survey Strategy

Q: What’s the ideal number of questions in a B2B customer survey?

A: It depends on your audience. Executives typically respond best to 5–8 questions, while ICs and managers can handle 10–15. Keep open-ended questions to 1–2 to avoid survey fatigue and ensure higher completion rates.

Q: How do I write survey questions that generate usable customer evidence?

A: Start by aligning each question with a specific goal or proof point you want to collect. Use plain, specific language, avoid jargon, and frame testimonial-style questions in a way that prompts detail (e.g., “How has our product streamlined your workflow?” vs. “What do you like about us?”).

Q: Should I incentivize customers to complete my survey?

A: Incentives can help boost responses, but be careful how you frame them. According to FTC guidelines, you can offer rewards for completing a survey—but not in exchange for a positive review. Be transparent and ensure your ask complies with current regulations.

Q: What’s the best tool for sending B2B customer surveys?

A: It depends on your goals. If you need robust analytics, tools like Qualtrics or Alchemer are great. For more advocacy-focused evidence collection, purpose-built tools like UserEvidence offer features tailored for marketing use cases. Simpler tools like Typeform or Google Forms work for quick, lightweight feedback but may lack key functionality.

Q: How can I increase response rates on my customer surveys?

A: Personalize the sender, explain what’s in it for the customer, and time your ask intentionally (e.g., midweek mornings). Use multiple channels like email, in-app prompts, or CSM follow-ups, and don’t forget to send polite reminder waves.

Q: Can I reuse one survey across all customer segments?

A: It’s better to match each survey to a specific audience and objective. For example, onboarding feedback should target recent launches, while advocacy surveys should go to high-satisfaction customers. Tailored targeting leads to better insights and avoids irrelevant responses.

Q: Where should I build surveys into the customer lifecycle?

A: Key moments include 90 days post-onboarding, after major feature adoption, before renewal/expansion, and annually for census-style surveys. Always-on surveys tied to lifecycle triggers help you collect feedback passively and proactively.