Explore the whole series:

Part 1 (you are here!): Finding Your Evidence Gap & Making a Plan

Part 2: How To Build Your Customer Evidence Library

Part 3: Making Sure Your Hard-won Evidence Gets Used

Grab the 90 day checklist here (no gates–promise)

TL;DR

Customer and product marketers are constantly scrambling for proof points—and the old-school approach to customer evidence just isn’t cutting it.

This is part one of our three-part series on building a strategic customer evidence program that actually scales. First step? Finding your Evidence Gap—the disconnect between what buyers need, what sales can use, and what marketing’s actually creating.

Here’s what you’ll get from this post:

- Why proof points (especially the stat-backed kind) matter more than ever in B2B

- How to spot the gaps in your current customer evidence—and how they’re slowing down your GTM motion

- The five-step plan to get organized: align to goals, inventory what you’ve got, talk to teams, dig into the data, and show impact

- Two solid ways to get started: a Customer Census Survey or a quick-hit focused project

- Real-world inspo from teams like HackerOne, using customer evidence to fuel sales, marketing, and product—without reinventing the wheel every time

If your customer evidence feels scattered, stale, or buried in a shared drive somewhere, this post is your jumpstart to something better.

“Do we have a customer story in healthcare? I’m working a deal and need something ASAP.”

“I’m in a deal with that competitor undercutusonprice.io again. Do we have anything that shows why customers choose us over them?”

“Leadership wants to see more ROI stats from our enterprise customers this quarter.”

Sound familiar?

If you’re a product marketer or customer marketer in the B2B software world, your days are probably filled with last-minute requests for customer stories, testimonials, and ROI proof points. And despite all your hard work creating those case studies and collecting those quotes, the cycle never ends.

Here’s the painful truth: the traditional approach to customer evidence isn’t working anymore. Your buyers have changed, your sales team needs more coverage, and those carefully crafted case studies are collecting digital dust stuck under the Resources tab on your marketing site.

In this first post of our three-part series, we’re going to introduce a better way: building a strategic customer evidence program. More importantly, we’ll help you identify your specific “Evidence Gap” and create a concrete plan to close it. No fluff, no jargon—just actionable steps to transform how your company captures, curates, and leverages customer proof.

The way we approach this whole customer storytelling game has to change, and we’re here to lay out where it’s headed and how you can put yourself at the forefront of it—all in service of becoming an indispensable resource to your GTM teams.

What is Customer Evidence and The Evidence Gap?

Let’s start with the basics. Customer evidence isn’t just case studies and testimonials—it’s the entire spectrum of verified proof that your product delivers value.

Customer evidence includes:

- Statistical evidence and quantifiable ROI data (e.g., “97% of UserEvidence customers saw a more complete library of customer stories across industries, company sizes, and personas”)

- Feature-specific validation (detailed feedback on specific product capabilities)

- Competitive evidence (why customers chose you over alternatives)

- Industry-specific proof points (validation for specific verticals)

- Account-level stories (comprehensive case studies)

According to our original research for The Evidence Gap report, 51% of buyers said statistical evidence was the most trustworthy type of customer proof they could receive. Yet 40% of buyers report they don’t see this type of evidence from vendors. Meanwhile, marketers are prioritizing less impactful forms of evidence––only 38% of marketers said they want to create more statistical evidence.

This misalignment creates what we call “The Evidence Gap”: buyers need verified, unbiased proof from software vendors, but customer evidence often lacks the substance and relevance needed to make the sale.

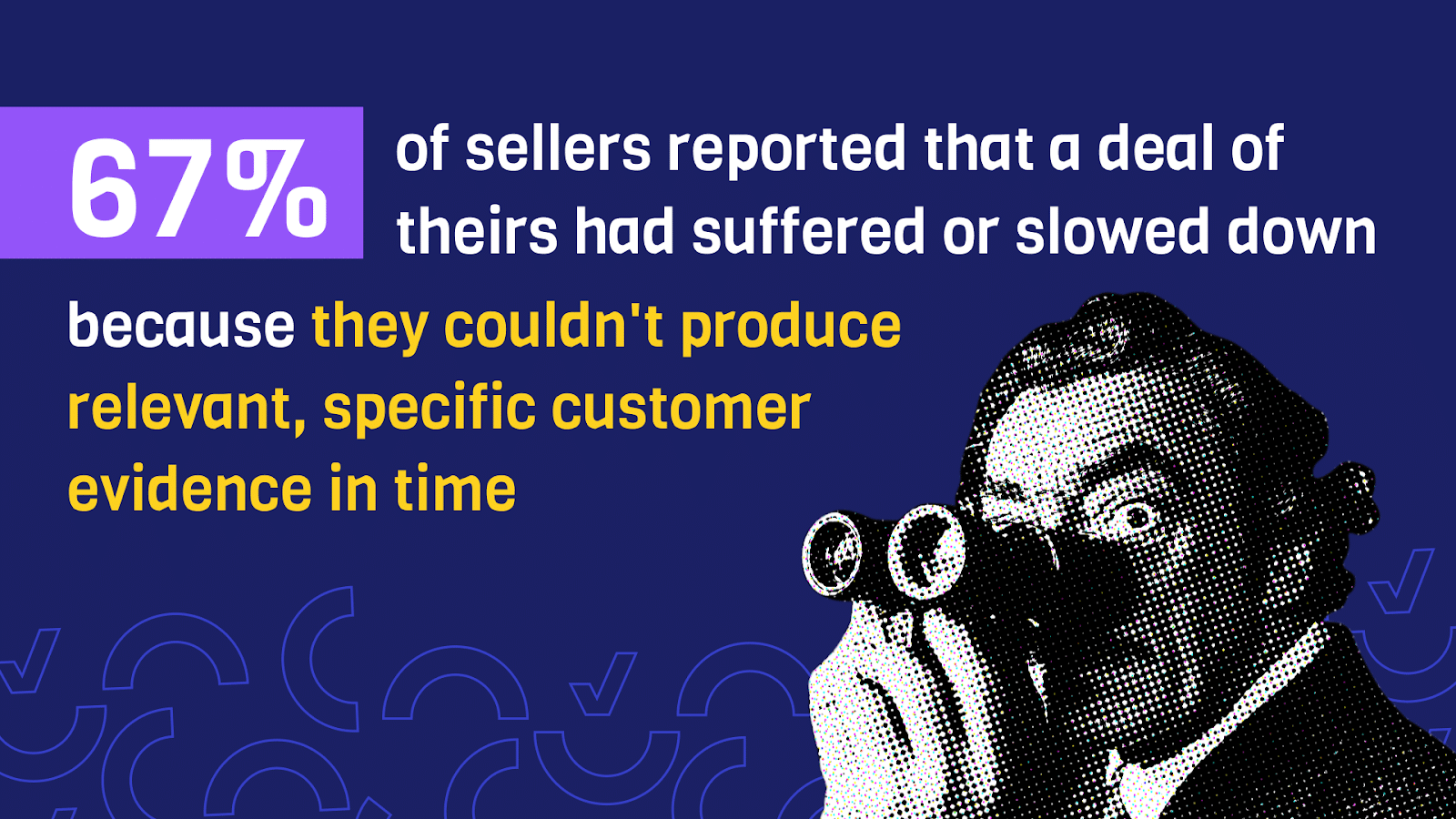

Why does this matter now more than ever? Our research found that 67% of B2B buyers consider a compelling, statistically significant ROI business case crucial to their buying decision. But the evidence has to be relevant—70% of those same buyers emphasized it needs to be specific to their industry.

Meanwhile, sales teams are hurting.

This disconnect between what buyers need, what sellers can provide, and what marketing teams produce? That’s the Evidence Gap, and it’s costing you deals, wasting marketing dollars, and keeping marketers spinning their wheels in place.

The current landscape: Why customer evidence matters more than ever

B2B buying has fundamentally changed over the past few years:

- Larger buying committees: According to our research, 54% of buyers reported more than five internal stakeholders now get a say in the buying process.

- Increased due diligence: 46% of buyers said their required due diligence has increased in the past three years. (TrustRadius)

- Buyer skepticism: Buyers cite tighter budgets, more sophisticated scams, increasingly complex software solutions, and an ever more crowded market as reasons for heightened scrutiny.

This creates a perfect storm where buyers need more proof before purchasing, while marketers struggle to provide relevant, credible evidence that moves the needle.

As one participant in our research put it: “There are so many new vendors with big promises and lots of fake reviews. It’s hard to know if something is legit.”

Want more?

TrustRadius + Pavilion put out a report about the buying disconnect, and according to their research the top three GTM challenges were, in order:

- Sales and marketing effectiveness — 24% of respondents

- Compelling positioning and messaging — 16%

- Competitive landscape — 15%

Customer evidence directly tackles all three of these challenges.

It’s tough out there. Growth is hard to come by. Marketing teams who phone it in and produce three boilerplate case studies a quarter in the same way they have for 15 years will continue to lose influence.

But this isn’t fear factor. We’re eternal optimists here. The fact that case studies have stayed the same for so long is an incredible opportunity for marketers to innovate and become a linchpin for their entire GTM org. Let’s talk about the differences a customer evidence program offers marketers.

What is a customer evidence program and how is it different?

When I was starting out, I’d chase any customer story I could get. A healthcare logo? Great! A financial services testimonial? Perfect! But I was creating a patchwork quilt of evidence that wasn’t actually helping anyone. There was always a different ask or a new focus from leadership to run at.

I got a little more experienced and set some more stringent parameters to try and improve my customer evidence game. I’d align case studies with industry campaigns for a quarter. I also had a rule: I wouldn’t publish a case study if it doesn’t include measurable impact. As a product marketer I was focused on validating claims and making sure the effort we put in could support a broader narrative. I was on the right track.

But it was a grind. We were still going one by one, trying to eke out a few case studies a quarter, the uptake was slow going.

This is how most companies are, unless they’ve invested an incredible amount into producing a slew of stories from a very willing customer base. Even then, these companies are typically falling into the trap of generic customer storytelling.

Time for a change.

A customer evidence program is a strategic, scalable approach to collecting, curating, and sharing customer proof throughout your organization. Unlike the traditional approach of creating one-off case studies, a proper program treats customer evidence as a continuous, company-wide asset.

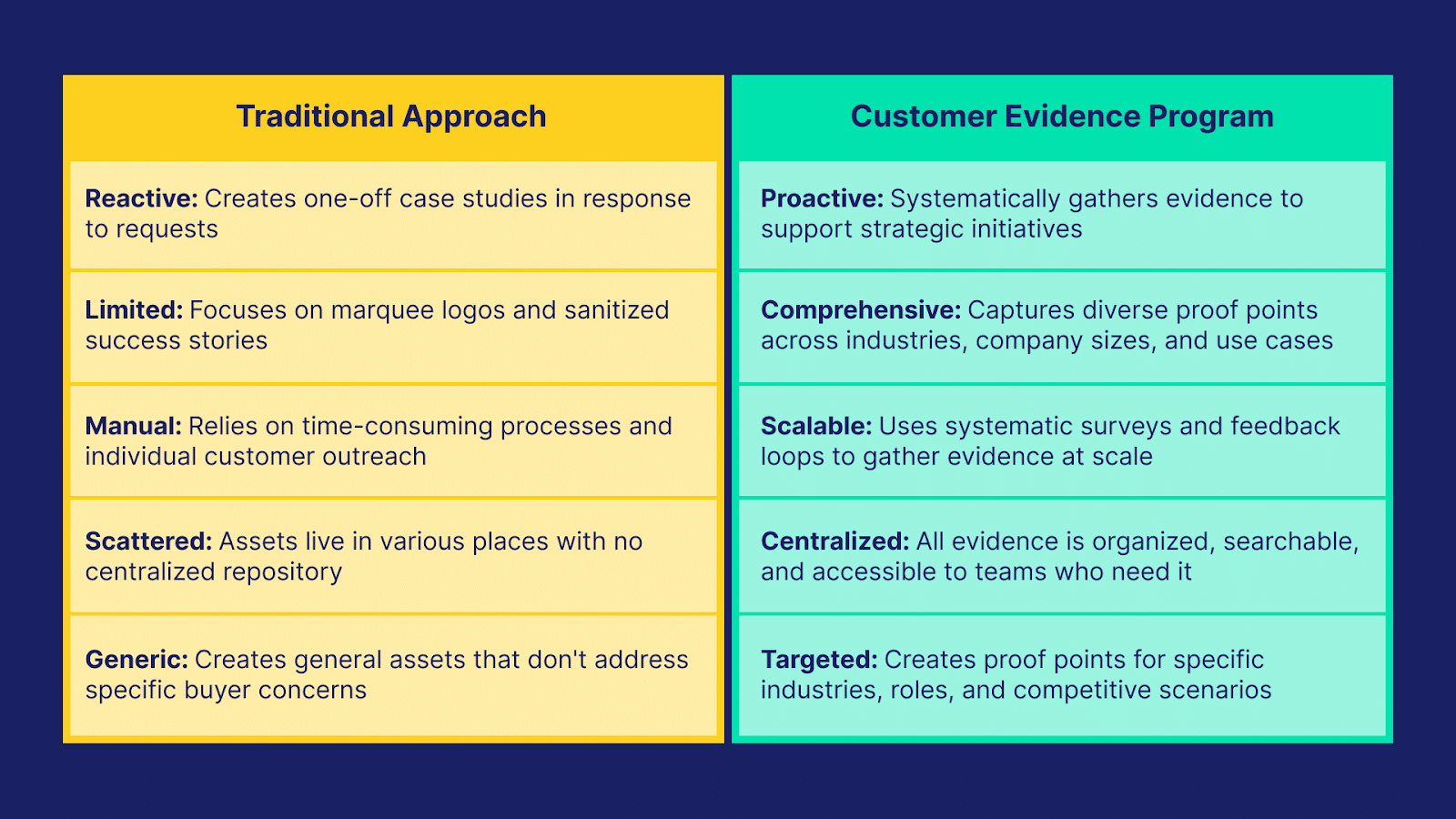

Let’s compare the old way with a customer evidence program:

Note a few words we’re using here: strategic, proactive, comprehensive. Before you dive into collection it’s important to take stock of where you’re at and make a plan your team can buy into. Luckily, we’ve got clear guidance for you on how to do that.

Finding your Evidence Gap: The audit

Let’s walk through a practical audit process to identify your Evidence Gap.

Step 1: Align with current company initiatives

Start by understanding what really matters to your company over the next year. The most successful customer evidence programs directly support your company’s strategic priorities. Whether you use OKRs, KPIs, or holiday hoobeewhatee’s (where my Grinch fans at), any program you want execs to care about has to serve those objectives.

Ask yourself:

- What are your company’s top 3-5 strategic initiatives for the next 12 months?

- Which new markets or segments is your company trying to break into?

- What products or features are launching soon?

- Are there specific competitors your executive team is concerned about?

Step 2: Take stock of your current evidence

Now, let’s assess what you already have. Create a simple spreadsheet with these columns:

- Type of evidence (case study, testimonial, ROI stat, etc.)

- Industry

- Company size

- Product/feature highlighted

- Use case

- Date created

- Where it lives (website, sales deck, etc.)

For bonus points, add a “Strength” column (1-5) that rates how compelling and specific each piece of evidence is.

Once you’ve cataloged everything, look for patterns:

- Do you have massive gaps for certain industries?

- Is all your evidence outdated?

- Are there key products or features with zero customer validation?

- Do you have a healthy mix of evidence types, or just generic testimonials?

Step 3: Talk to your teams

Your sales and marketing teams are goldmines of insight about where your evidence falls short. They’re on the front lines hearing objections and fielding requests. So, you’ve gotta talk to them.

And, lucky you, we’ve got worksheets to help you facilitate those conversations right here.

For the TL;DR, here’s a structured approach to interviewing key stakeholders based on our worksheets:

Questions for Sales Leaders:

- Where do you see the biggest challenges for your sales team in advancing deals?

- Are there consistent points in the sales cycle where deals tend to stall?

- What types of customer evidence would be most impactful for your team?

- How well-equipped is your team to handle competitive objections?

- Are there specific deal stages where evidence could make the biggest difference?

Questions for Sales Teams (AEs/SDRs):

- Where do you see the biggest drop-offs in the sales funnel?

- Which persona is hardest to move through the funnel?

- Which competitors are we losing to most often, and why?

- What are the most common objections you hear from prospects?

- What’s a common “aha!” moment that helps buyers see the value of our product?

Questions for Marketing Leaders:

- Which buyer personas or industries are we targeting most aggressively?

- Are there any new markets or regions we are planning to expand into?

- Are there specific industries or verticals where we lack strong proof points?

- Which types of customer evidence have the most impact on campaigns?

- How well does our current customer evidence address objections from buyers?

Pro tip: Create a “strike team” of 2-3 reps who you trust and who will give honest feedback. Meet with them regularly to test new evidence and identify emerging gaps.

Step 4: Examine your metrics

Numbers don’t lie. Look for quantitative signals that Evidence Gaps are hurting your business:

- Competitive win rates – Are they declining overall or in specific segments?

- Outbound engagement rates – Are prospects responding to your outreach?

- Sales cycle length – Where do deals get stuck?

- Deal slippage – How many deals pushed from last quarter?

- Lost deal analysis – How many mentions lack of proof or credibility?

- Campaign effectiveness – Could conversions on campaigns in specific segments use a boost? Or more broadly, are you able to support specific campaign segments with customer evidence at all?

Step 5: Quantify the opportunity

Based on your findings, estimate the potential impact of closing your Evidence Gap:

- If improved customer evidence could increase your competitive win rate by just 5%, what would that mean for revenue?

- If you could shorten your average sales cycle by two weeks, how many more deals could you close each quarter?

- If your outbound response rates improved by 10% with better customer evidence, how many more opportunities would that create?

These numbers will be crucial when making the case for investment in your program.

Making a plan (and getting buy-in)

Now that you’ve identified your Evidence Gaps, it’s time to create an actionable plan to close ‘em.

Two great places to start

There are two proven approaches to kick off your customer evidence program:

Option 1: The Customer Census Survey

Launch a comprehensive survey to all customers 2-4 times per year. This creates a baseline of evidence across your customer base and catches emerging trends.

A good census survey includes:

- NPS or satisfaction metrics

- ROI and business impact questions

- Feature usage and value questions

- Competitive intelligence questions

- Customer advocacy interest

We’ve got a survey template you can use right here—check the Customer Baseline Survey.

Option 2: The Focused Project

Target a specific gap with a laser-focused evidence collection project. This works well if you’re trying to prove value for:

- A new product feature

- A specific vertical (e.g., healthcare, financial services)

- A competitive battle (e.g., why customers choose you over Competitor X)

- A specific use case

This could look like a targeted survey, customer interviews, or culling through existing evidence to make sure you’ve got all of the relevant evidence for this gap in one place. Once you’ve got it all gathered and organized, you’ll have all of the puzzle pieces you need to start creating assets that will fill the gap.

Check our survey templates for these options as well.

The focused approach often delivers faster results and can help you demonstrate the value of your program quickly. You can think of it as a pilot if it helps get buy-in.

When you get asked about needing a tool for this

You’ll likely get questions about doing it yourself during this process. Why can’t we use a cheap survey tool and in-house resources to get this done? Here are a few considerations, or check this post for some more detail:

The Manual Approach:

- Create surveys using tools like SurveyMonkey or Google Forms

- Track responses in spreadsheets

- Create individual assets in design tools or get your brand team to do it

- Store everything in shared drives

- Create and maintain a catalog of what’s available, share with the sales team and hope they use it

This works for basic evidence collection but quickly becomes unwieldy at scale. It requires continual work from multiple areas of marketing and a high level of on-going maintenance.

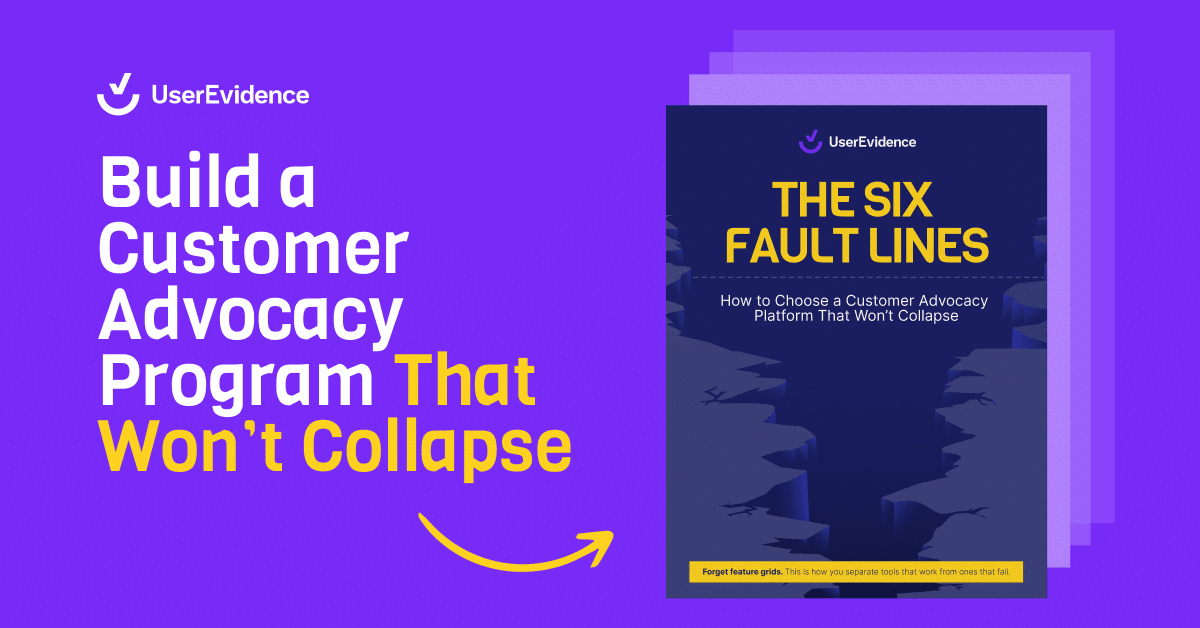

The Purpose-Built Approach: Using a platform like UserEvidence gives you a complete system to:

- Collect – Send targeted surveys, integrate with review sites, and capture feedback from calls

- Curate – Organize evidence by industry, product, company size, and more

- Share – Create on-brand assets and deploy them to your teams

Either approach can work, but the right tools make scaling your program much easier. It’s important to make it clear what you’d sacrifice by doing this manually, and how it drains resources from multiple areas of marketing (like design).

Getting buy-in

To secure support for your customer evidence program, you need to build a compelling business case:

- Highlight the gap – Use your audit findings to show exactly where evidence is missing

- Quantify the opportunity – Translate the gap into potential revenue impact

- Outline your approach – Present a clear plan with timelines and responsibilities

- Define success metrics – How will you measure the program’s impact?

Your argument should focus on specific business outcomes, not just marketing deliverables. For example:

❌ “We need more case studies for our website.”

✅ “Our win rate against Competitor X is 15% below our overall average. A targeted evidence collection project could give our sales team the competitive proof points they need to improve this by at least 10%, representing $2M in additional pipeline per quarter.”

Share your early successes widely. As Cache Walker, Director of Customer Marketing at Trellix, explains: “When you can say, ‘Hey, here’s the impact our CSMs achieved through customer marketing last quarter; here’s what it did for our Sales team,’ that’s when people really start to buy in.”

A phased implementation plan

Like most marketing initiatives, successful customer evidence programs follow a phased approach. Here’s a realistic timeline that we’d recommend:

Phase 1: Kickoff (Weeks 1-6)

- Complete your evidence audit

- Design and distribute your first survey

- Produce initial quick-win content

- Set up your organization system

- Identify early champions in sales

Phase 2: Publishing and Integration (Weeks 7-12)

- Create a regular cadence of evidence collection

- Develop templates for common evidence formats

- Integrate with existing sales enablement tools

- Train teams on accessing and using evidence

- Begin measuring impact metrics

Phase 3: Enablement and Optimization (Months 3-6)

- Create a feedback loop with sales teams

- Refine collection methods based on results

- Expand to additional evidence types

- Begin integrating with marketing campaigns

- Optimize based on usage and impact data

A real-world example: How HackerOne is scaling customer evidence across GTM

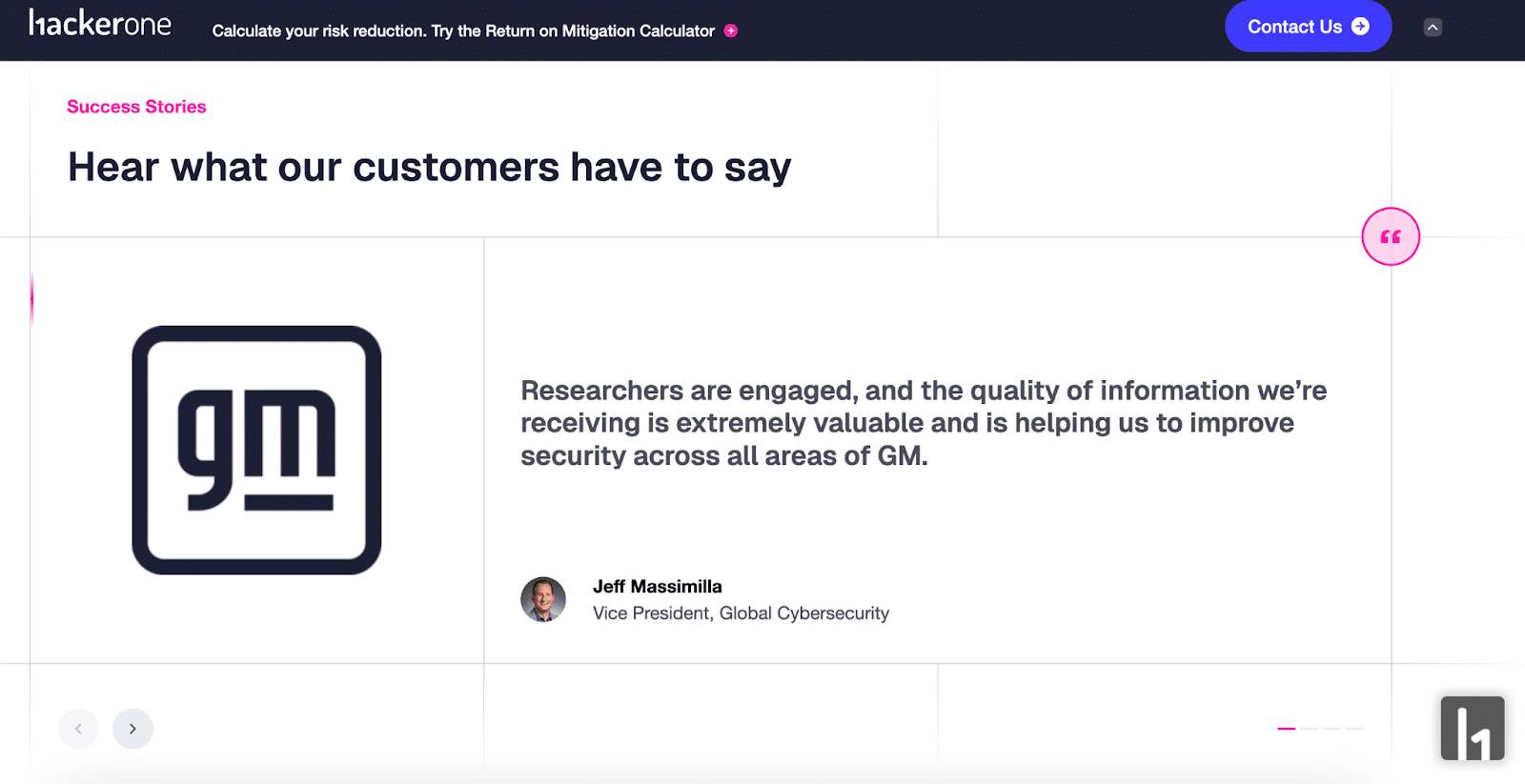

Let’s take a look at how HackerOne, a leading cybersecurity platform, is putting a modern customer evidence program into action.

HackerOne didn’t just want a few shiny case studies. They wanted a scalable system to bring real customer proof into every part of their go-to-market motion—from top-of-funnel marketing to competitive sales plays and customer expansion.

Here’s how they’re doing it:

1. Start with a repeatable feedback loop.

HackerOne uses regular customer surveys to collect feedback, uncover proof points, and identify customer champions. This gives them a scalable foundation of customer data—everything from ROI stats to product-specific validation. And because the survey is structured and repeatable, they can run it consistently to keep content fresh.

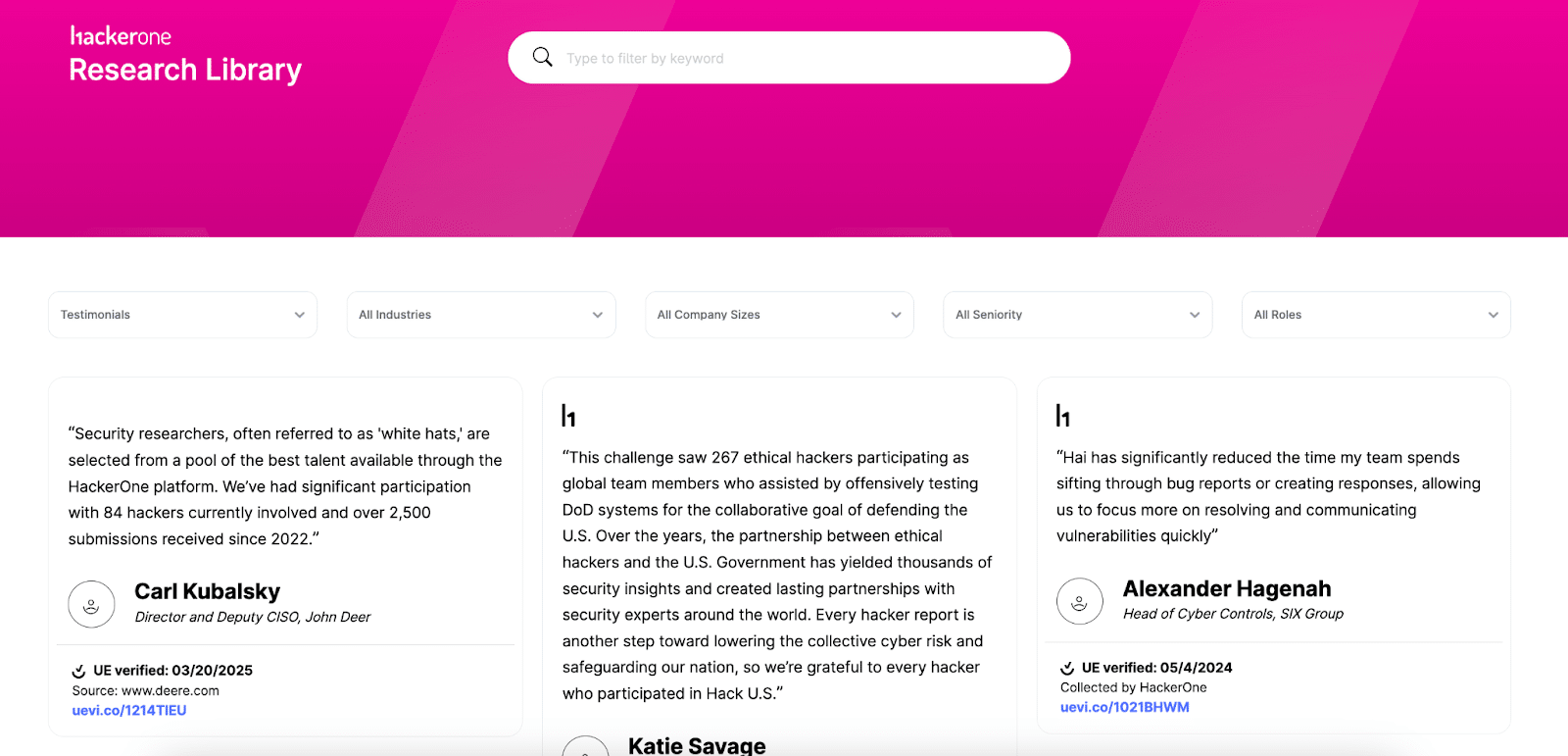

2. Build a searchable library of modular content.

Instead of relying on longform case studies that go stale quickly, HackerOne breaks down their customer feedback into bite-sized, modular assets: quotes, ROI stats, product callouts, and competitor comparisons. These are organized in a central, searchable platform that sales and marketing teams can access on demand.

3. Align content creation with GTM priorities.

They use customer evidence to support specific company initiatives—like vertical expansion or product launches—so the content being created always maps back to what the business is focused on. Whether the sales team needs proof points to beat a competitor or the marketing team is running an industry campaign, customer stories are always relevant and ready.

4. Enable teams with plug-and-play assets.

HackerOne makes it easy for internal teams to use customer evidence. They create pre-built slides, visuals, and snippets that sales, customer success, and marketing can drop into decks, campaigns, or outbound emails without starting from scratch.

5. Track impact across the funnel.

Customer evidence isn’t just for show. HackerOne tracks usage and influence across pipeline and revenue metrics, giving their team a clear line of sight into how evidence is helping close deals and move opportunities forward.

The result? A program that’s not just collecting stories—it’s driving action. As one of their leaders put it: “We’re not guessing what content to create anymore. We’re letting the voice of the customer guide us.”

What’s Next?

In this post, we’ve explored how to identify your Evidence Gap and create an initial plan.

In our next post, we dive deep into the most effective ways to collect customer evidence, including survey design best practices, incentives that actually work (without violating FTC rules), and how to turn raw feedback into compelling proof points.

Ready to get started? Begin with these three immediate action items:

- Schedule a 30-minute meeting with your sales leader to identify the top 3 evidence gaps hurting deals right now

- Create a simple spreadsheet to inventory your existing customer evidence

- Draft a basic plan for either a customer census survey or a focused evidence project

Have questions about building your customer evidence program? Schedule a chat with our team. We’d love to hear about your specific challenges and help you tackle them.