Explore the whole series:

Part 1 : Finding Your Evidence Gap & Making a Plan

Part 2 (you are here!): How To Build Your Customer Evidence Library

Part 3: Making Sure Your Hard-won Evidence Gets Used

Grab the 90 day checklist here (no gates–promise)

TL;DR

So you’ve mapped out your customer evidence needs—now it’s time to actually build the thing. This post breaks down how to go from “we need proof” to a living, breathing library of evidence your sales and marketing teams will actually use.

We’ll cover the two big pieces:

Collecting customer evidence

- How to source high-quality insights from:

- Surveys (your most controllable and scalable source)

- Review sites, customer calls, product usage data

- Smart strategies to design surveys that actually get responses

Curating customer evidence

How to turn raw feedback into usable assets:

- Organizing quotes, stats, and stories so they’re easy to find

- Creating collections for personas, industries, competitors, and more

- Tips to avoid the classic “we have great evidence but no one’s using it” trap

Whether you’re starting from scratch or leveling up what you’ve already got, this guide walks through how to build a scalable customer evidence engine—without drowning in spreadsheets.

You’ve identified your evidence gaps and mapped out what you need. Now it’s time to dig into the core work: actually building your customer evidence library.

If you’re like most product marketers or customer marketers I’ve worked with, this is where things can get overwhelming fast. How do you get enough customer evidence to start? How do you keep things organized? How do you set things up so usage isn’t a major blocker for your team?

In this second installment of our series, I’ll walk you through the nuts and bolts of building a customer evidence library that your GTM teams will actually use (and maybe even thank you for).

There are two main steps to build your library, and this is how we’ll frame this post.

- Collecting customer evidence — Gathering different types of customer evidence from multiple sources. We’ll mostly focus on survey strategies, but will touch on other places to collect from.

- Curating customer evidence — Finding the good stuff within the collection, organizing it, and preparing it for use in market.

First, let’s talk about collecting customer evidence.

What sources can you use to collect customer evidence?

Before diving into survey strategies, let’s explore all the available sources for collecting customer evidence. The good news? You likely already have more customer evidence at your disposal than you realize.

Sources for customer evidence collection

1. Third-Party Review Sites: Sites like G2, Capterra, and TrustRadius are goldmines for unfiltered customer feedback. Your customers are already sharing their experiences there—why not leverage it?

- What you can gather: Testimonials, feature ratings, competitive comparisons

- Pros: Viewed as more credible by prospects because they’re not controlled by you

- Cons: Limited control over messaging, may not address your specific evidence gaps

2. Customer Call Recordings: Sales and customer success calls contain authentic voice-of-customer insights.

- What you can gather: Detailed use cases, objection handling, competitive intelligence

- Pros: Natural, conversational feedback in the customer’s own words

- Cons: Time-consuming to review, requires additional permission to use

3. Customer Data: Usage metrics, adoption rates, and other product data can provide quantifiable evidence.

- What you can gather: Engagement stats, feature adoption, usage patterns

- Pros: Objective, quantifiable data specific to your product

- Cons: Sometimes deals with lack of trust from buyers due to internal sourcing if used in a customer evidence context.

4. Surveys: The most direct and controllable method for gathering net-new specific customer evidence. Still the best collection method out there.

- What you can gather: Quantifiable ROI, testimonials, competitive insights, targeted feedback

- Pros: Highly customizable, systematic, scalable

- Cons: Requires strategic design and customer participation

While each source has its place, surveys remain the most versatile and powerful tool for building a comprehensive customer evidence library—especially when you need to fill specific gaps. Let’s explore how to make them work for you.

Building effective surveys: Your primary collection method

Surveys give you the most control over what evidence you collect and how you collect it. They’re the foundation of any robust customer evidence program.

Choosing your first survey

As mentioned in the first post of this series, we recommend starting with one of two survey options. Don’t try to boil the ocean by building a complex program quickly. Begin with either:

- A census survey – A broad survey sent to all customers to establish baseline metrics and gather general feedback

- A focused project – A targeted survey addressing your most pressing evidence gap (like that competitive intel your sales team desperately needs)

The right choice depends on your immediate needs. If your sales team is losing competitive deals because they can’t articulate why you’re better than Competitor X, start there. The focused project is also good if you need a quick win to prove value against a key company initiative for leadership. If you need a foundation of customer evidence across the board and leadership is bought in, begin with a census.

Survey types for a complete program

As your program matures, you’ll want to incorporate these survey types:

- Customer census survey (aka customer baseline survey): Your foundational survey for capturing overall sentiment, NPS, and initial testimonials

- Competitive survey: Focused on why customers chose you over competitors

- Product-specific survey: Deep dives into feature usage and specific value drivers

- Post-renewal survey: Captures the “why” behind customer retention

- Customer onboarding survey: Measures initial experience and expectations

- Customer benchmarking survey: Identifies best practices among your customers

- Win-loss survey: Uncovers why prospects did or didn’t choose your solution

Each of these serves a specific purpose in building your library, and ideally, you’ll eventually have all of them working together in a programmatic surveying approach. This means they’re automated, sending at specific points in the customer journey, so your library is constantly growing without additional work from you.

We have 7 survey templates for each of these ready for you if you’re ready to get started today. Survey design is an art and a science. We cannot understate the impact survey design will have on your results, so we’ve put all our experience to work for you with these templates.

On that front, if you’re looking to dive deep into survey tips, here is a bevy of advice we have on the topic:

- Survey design best practices from our leadership team (over a decade of direct survey experience)

- How to launch customer surveys that actually get responses

- How many of these common survey mistakes are you making?

- Everything our VP of marketing learned from sending his first customer evidence survey

- 9 questions you should answer before surveying your customers

- Your survey isn’t getting responses? Here’s what to do

Here are some initial tenets of survey design to get you started.

Building surveys that actually work

Surveys are the best collection method, but we can be honest and say that doesn’t mean they’re a joy to fill out. So how do you design surveys that actually get responses—and the right kind of responses at that?

Survey design best practices

Here’s what we’ve learned from sending thousands of customer surveys:

- Keep it short and focused: Aim for 5-13 questions total. You’ll get diminishing returns after that. 13 should be max for a census survey, aim for 5-6 for focused project surveys.

- Mix question types: Limit open-ended “testimonial” questions to 2-3 per survey. Include multiple choice and rating scale questions to gather quantifiable data.

- Ask for specifics: Instead of “How do you like our product?”, ask “What specific business challenges has our product helped you solve?” or “By what percentage did our solution improve your [specific metric]?”

- Think ahead to organization: Include classification questions about industry, company size, role, and use case so you can filter evidence later.

- Consider your output: If you want to create ROI statistics, make sure you’re asking questions that will give you percentage improvements, time savings, or other quantifiable metrics.

- Make it easy: Provide ranges for numeric questions instead of asking for exact numbers, which can be intimidating.

- Include advocacy identification: Add questions about willingness to participate in case studies, reference calls, or other advocacy activities.

Remember the goal isn’t just to collect nice things people say, but to gather concrete evidence that builds trust with prospects and moves deals forward. Testimonials don’t need to tell the whole story, they need to tell one specific anecdote well. ROI stats need to be believable and applicable to prospects’ working life. This is effective evidence.

Survey questions that deliver results

The difference between mediocre and powerful customer evidence often comes down to the questions you ask. Here are some proven questions that deliver results:

For quantifiable ROI data (note this obviously needs to match your value drivers):

- “By what percentage have you [increased revenue/decreased costs/improved efficiency] since implementing our solution?”

- “How much time does our solution save your team per [week/month/quarter]?”

- “How many deals involved the [output] from [your solution] in the last quarter?”

For competitive evidence:

- “Which solutions did you evaluate before choosing us?”

- “What was the primary reason you selected our solution over alternatives?”

- “What capabilities do we provide that your previous solution lacked?”

Advanced tip: Using a competitive identifier like the first question can be used in tandem with other ROI questions to create specific competitive proof points. “Customers who came to us from X competitor saw Y result.”

For feature-specific validation:

- “Which feature of our product do you find most valuable? Why?”

- “How has [specific feature] helped your team accomplish its goals?”

- “Which feature would you miss most if it were removed?”

Delivering surveys for maximum impact

Even the best-designed survey won’t help if no one responds. Here’s how to maximize your response rates:

Nail the art of the ask

The way you frame your survey request dramatically impacts response rates. Here’s what works:

- Make it personal: Have the request come from someone the customer has a relationship with (their CSM or account manager).

- Tell the story: Explain why you’re asking and how it will benefit them (improved product, better service, etc.).

- Nail the subject line: Make it clear and compelling. “Help shape the future of [Product]” or “Your feedback needed: 5-minute survey” works better than “Customer Satisfaction Survey.”

- Offer an incentive: Be direct about what’s in it for them. Gift cards work best in our experience, with $25-50 being the sweet spot for most B2B audiences.

- Be transparent about time: If it takes 5 minutes, say so. If it takes 15, be honest about that too.

Mass-email isn’t your only surveying channel

Don’t rely solely on email. Consider:

- In-app surveys: Catch users when they’re actively engaged

- CSM-delivered requests: Have your customer success team follow up personally

- QBRs and check-ins: Dedicate time during regular meetings to gather feedback

- Post-support interactions: Follow up after positive support experiences

Consider always-on surveying

The most sophisticated customer evidence programs don’t rely on one-off campaigns. Instead, they implement programmatic surveying tied to key moments in the customer journey:

- After customer onboarding (90 days post-purchase)

- Following major feature adoption

- At renewal or expansion points

- After achieving significant milestones or ROI

- Annually for your customer census

This approach ensures a steady stream of fresh evidence and reduces the “emergency” scrambles when sales suddenly needs a new industry case study.

My biggest hack: embrace anonymization

One of the biggest barriers to collecting powerful customer evidence is customers’ reluctance to go on record. Offering anonymization can dramatically increase response rates and honesty.

With anonymization, you can use the evidence without the customer’s name or company, like: “A Director of Marketing at a mid-size SaaS company” instead of “Jane Smith at Acme Corp.”

The tradeoff is between specificity and volume. Named testimonials carry more weight, but anonymous feedback is better than no feedback at all. A balanced approach is best.

Our friend and advisor Jason Oakley wrote an awesome article about how to best collect and use anonymized ROI stats. It’s definitely worth a bookmark.

How to curate customer evidence to build your customer evidence library

You’ve collected great customer feedback. Now comes the next critical part: organizing it so it’s actually useful.

Finding the gold in your responses

Without a customer evidence platform like UserEvidence, you’ll need to manually review responses to identify the best quotes and metrics. Look for:

- Feedback from within your ICP

- Specific, quantifiable results

- Clearly articulated business value

- Emotional language that conveys enthusiasm

- Surprising or unique use cases

- Competitive comparisons

Pay special attention to responses that align with your key messaging pillars and value propositions. This is the product marketing dream: messaging validated by ample supporting customer evidence.

Organizing your feedback

If you’re doing this manually, a well-structured spreadsheet can work as your foundation:

- Create a master spreadsheet with tabs for different evidence types (testimonials, ROI stats, competitive intel). Most survey tools should be able to get you started with an export.

- Include key metadata with each piece of evidence: customer name and company (or anonymous identifier), industry, company size, role, product or featured reference, date collected, approval status, usage permissions, etc.

- Tag and categorize each piece of evidence by areas that matter to your company. These are vital for discovery: buyer persona, industry, use case, value driver, product/feature, competitor mentioned (if any)

- Link to full responses for context

- Track usage to know which pieces are getting traction

There are a few pitfalls we have to cover here if you decide to do this manually.

- The spreadsheet works best for testimonials, which are easiest to organize and cover.

- For any aggregated evidence like research data to end in charts or ROI stats, you’ll have to do more work to manually aggregate this in the spreadsheet tool or with your data team.

FYI–there’s more organization to be done with your final assets if you aren’t using a dedicated platform, but that organization–whether in a GDrive or otherwise for final files–should match your categorization used in your evidence library.

Turning raw evidence into usable assets

Raw survey responses rarely make good sales or marketing assets on their own. You need to transform them into assets your team can easily deploy. If you don’t, you know how this ends… with that slide the AE designed (or worse, evidence never getting used at all).

You should design for distribution. We’re bringing this up during the curation phase because you need to have a plan for how and where your library gets used. This typically means bringing design into the fold and creating some expectations and process around branding customer evidence or having an alternate plan for getting this done.

Branding considerations and blockers

Consider the different types of evidence you’re creating and how best to visualize them. Here are some examples (and if you want to see them in action, we’ve hyperlinked best-in-class examples to each header for you to check out):

- ROI statistics: Clean, branded visualizations of key metrics

- Testimonial cards: Short, impactful quotes with customer info included

- Research charts: Great for questions driving comparison data or trend data

- Longform case studies: Full customer stories detailing their use of your product and its impact

- Reports/ROI studies: Aggregate customer evidence into a cohesive story shared together

You’ll need a way to translate your data into different assets for your sales and marketing teams to use—think: graphs, charts, stat cards, and testimonial graphics. For charts and graphs, you can use the native features in GSheets or Excel to get you started, but at the end of the day, it’s likely worth investing in some design help. Brand standards will likely dictate this need.

If you’re not using UserEvidence, work with your design team to create templates that ideally sales and marketing can easily populate with new evidence. If not, you’ll have to put in a new request for every new asset you want to create.

Consistency in branding makes your evidence more credible and usable. Some asset design best practices:

- Develop branded templates for different asset types

- Maintain consistent visual language across all evidence

- Consider different formats for different channels (social vs. sales decks)

- Make assets easily customizable for different needs

This part of the process can be a major blocker. There can be a lot of permutations, but that’s because customer evidence should be used everywhere. Getting stuck in the design queue will slow down delivery and impact. Setting expectations early with them can help get ahead of this.

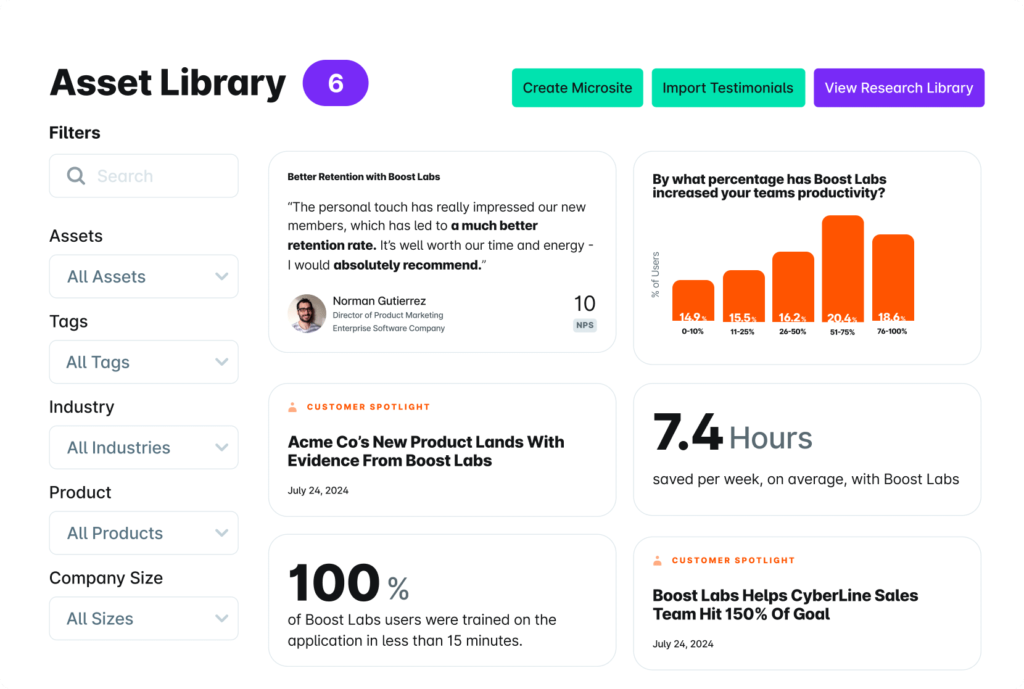

Creating your customer evidence library

Once your assets are ready, it’s time to organize them for access by your team. We recommend creating curated collections for specific purposes:

- 5 star bangers: You don’t need to call them this, but if you have a small collection of best-of-the-best high level marquee evidence, its nice to bring it together here. Oftentimes leadership will use these for board presentations, live events, etc.

- Industry collections: All evidence related to healthcare, financial services, etc.

- Persona collections: Evidence that speaks to your specific buyers

- Competitive collections: Evidence that positions you against specific rivals

- Product collections: Evidence supporting specific products you offer or key features

- Use case collections: These specific uses are often used by sales to answer job-to-be-done related questions

These collections make it easy for sales and marketing to find exactly what they need without digging through your entire library. UserEvidence customers know these as microsites.

Does this seem like a lot? We’re going to unabashedly tip our hand here. The manual process described above is the way most product and customer marketers have tried to wrangle customer evidence in the past (fourth wall moment–it’s exactly the way I’ve done it previously). All the overhead and difficulty of this is why we exist as a platform.

With a platform like UserEvidence, this whole process is centralized and optimized. We collect feedback, help you organize it automatically based on classifiers, create ROI stats for you automatically from survey responses, and give you an asset library that’s searchable and filterable for your team.

We also offer out-of-the-box branded templates for your assets, exportable in whatever format you need. Custom themes also mean your design team (or you using our simple Canva-esque editor) can design once for all your assets moving forward. Check out some custom assets our customers have produced here. This removes the design roadblock, taking pressure off of them and allowing you to produce on-brand assets in seconds.

There’s a reason we exist. This process works, you just need the right tool to support it. You can see it in action in our interactive Demo Ranch.

All right, back to your regularly scheduled programming…

Identifying and nurturing advocates

As you collect evidence, you’ll naturally discover your most enthusiastic customers. These advocates are gold for your program in the form of event participation, reference calls, referrals, and more. We recommend including advocacy volunteer questions at the end of surveys to track willingness to participate.

There are a multitude of advocacy tools out there to track advocates and build an effective program. This is an entire other topic (check out the 2025 Customer Marketing Tech Landscape Report for a deep dive on options here). For the sake of starting up your customer evidence program, we’ll recommend you at least start tracking advocates from your survey feedback. Include a multiple choice (choose many) question like this at the end of your surveys to start tracking willingness to participate in advocacy activities:

Would you be willing to participate in any of these customer advocacy activities?

- Post a review on a review site (G2, Gartner Peer Insights, TrustRadius, etc)

- Take a reference call for a sales deal

- Participate in a Press Release

- Speak at an event

- Refer a friend or colleague

- Participate in a webcast/podcast

- Do a longer case study

- Participate in a video testimonial

Again, your execution on this front depends on your tooling. Manual tracking who is willing to do what and actual participation in a spreadsheet, CRM, or dedicated tool. UserEvidence customers can track advocates identified from surveys directly in the platform.

Putting it all together: A practical example

Let’s see how this might work in practice:

Cache Walker, Director of Customer Marketing at global cybersecurity company Trellix, wanted to move beyond traditional case studies and create a dynamic evidence system that could support sales teams worldwide, across different industries and use cases.

Here’s how they’re making it happen:

1. Organize evidence into three strategic buckets.

Cache breaks down their customer evidence into three clear categories that make it easy for teams to find what they need:

- Context: Evidence showing how the product works in specific industries and use cases

- Validation: Proof points that the solution delivers as promised (like ROI statistics)

- Trust: Evidence that builds confidence in both product and people

This simple framework transforms what can feel like an overwhelming initiative into something teams can easily understand and navigate.

2. Build with a modular, LEGO-block approach.

“I think the best way to think about evidence libraries is that everything is modular,” Cache explains. Rather than creating rigid, one-size-fits-all assets, Trellix treats each customer quote or data point as a building block that can be combined to create custom stories for different scenarios.

This approach not only makes their library more flexible but also simplifies the collection process—customers can contribute individual insights instead of committing to extensive case studies.

3. Democratize access across the organization.

“My philosophy is to democratize our library and make everything available to everyone,” Cache shares. For a global company like Trellix, this is essential—region-specific content won’t work worldwide.

They’ve built a well-organized, tagged, and searchable library using UserEvidence that ensures every team member can find relevant evidence, regardless of their region or the industry they’re targeting.

Want to see Trellix’s customer evidence library in action? Check it out here.

Advanced strategies for mature programs

Once you’ve established your foundation, consider these advanced strategies:

Industry research from your customer base

Move beyond product feedback to create industry insights. Use your customer surveys to gather data about industry trends, challenges, and benchmarks. This approach:

- Positions you as a thought leader

- Creates valuable content that isn’t just about your product

- Builds trust with prospects by showing you understand their industry

AI-powered customer evidence

If you’re using a platform like UserEvidence, take advantage of our AI capabilities to:

- Deliver insights from your surveys you can share across teams

- Surface the most impactful testimonials based on sentiment

- Generate recommended testimonials and case studies from customer calls

- Provide your team with recommended customer evidence in a chatbot experience (we’ll talk more about this next post)

If you’re doing this manually, try creating a customGPT populated with your customer evidence library. Your team can ask for specific customer evidence or more generally what customers say about a topic. It will take some training and manual upkeep to keep the data fresh but can be a great way to house your library in an accessible manner. We’ll dive deep into how to deploy and use customer evidence in our next post.

Common pitfalls to avoid

As you build your library, watch out for these common mistakes:

- Collection without curation: Gathering feedback without organizing it doesn’t get you anywhere. This will take the most time in managing your customer evidence.

- Focusing only on the positive: Ignoring constructive feedback misses opportunities for authentic improvement stories and feedback you can relay back to other departments. Doing this makes you a hub for customer evidence and insight.

- Over-reliance on longform case studies: Traditional case studies are just one type of evidence. Oftentimes your teams need a single proof point or example, introduce variety in length and format to tell the right story for the moment.

- Manual processes that don’t scale: Without automation, you’ll hit a ceiling on how much evidence you can manage. Disparate manual processes between collection, organization, approvals, branding, and eventually rollout create a massive amount of overhead.

- Treating all evidence equally: Not all customer feedback carries the same weight or relevance. Prospects want to see relevant evidence, your company has goals its running towards, your customer evidence should match both.

You’ve got your library, now what?

Building your customer evidence library is not a one-time project but an ongoing program. When done right, it becomes a living asset that grows more valuable over time without the overhead that can come with scale.

The most successful customer evidence programs share these characteristics:

- They’re programmatic rather than reactive

- They bring in quality and relevant evidence above all else

- They cover more than just testimonials and longform case studies

- They make evidence easy to find and use

- They are constantly growing

By the time you’ve delivered on the ideas in this post, you have a library of customer evidence ready to be shared with your team and used across your go-to-market.

In the third and final post of this series, we talk all about using customer evidence for big impact.

We cover topics like sales enablement, discoverability, use cases for marketing, all geared towards making sure all this hard work doesn’t go to waste. To make sure those goals and initiatives you are attaching to from part one are delivered against.

Have questions about building your customer evidence program? Schedule a chat with our team. We’d love to hear about your specific challenges and help you tackle them.